30 August 2018

Market snapshot

Equities - India

Sensex

Nifty-50

Nifty-M 100

Equities-Global

S&P 500

Nasdaq

FTSE 100

DAX

Hang Seng

Nikkei 225

Commodities

Brent (US$/Bbl)

Gold ($/OZ)

Cu (US$/MT)

Almn (US$/MT)

Currency

USD/INR

USD/EUR

USD/JPY

YIELD (%)

10 Yrs G-Sec

10 Yrs AAA Corp

Flows (USD b)

FIIs

DIIs

Volumes (INRb)

Cash

F&O

Close

38,723

11,692

19,827

Close

2,914

8,110

7,563

12,562

11,083

22,848

Close

77

1,207

6,073

2,147

Close

70.6

1.2

111.7

Close

7.9

8.7

29-Aug

-0.20

0.16

29-Aug

384

10,802

Chg .%

-0.4

-0.4

0.5

Chg .%

0.6

1.0

-0.7

0.3

-0.1

0.2

Chg .%

1.9

0.5

-1.0

1.7

Chg .%

0.7

-0.1

0.6

1MChg

0.28

0.00

MTD

0.0

0.8

MTD*

360

9,242

YTD.%

13.7

11.0

-6.2

YTD.%

9.0

17.5

-1.6

-2.8

-5.3

0.4

YTD.%

15.3

-7.4

-15.7

-4.8

YTD.%

10.5

-2.5

-0.8

YTDchg

0.6

0.8

YTD

-0.2

10.7

YTD*

357

8,441

Today’s top research theme

Yes Bank: India’s new-age private sector bank buiding size,

getting leaner

We hosted Mr. Rana Kapoor MD & CEO of Yes Bank. Key takeaways:

Key strategic enablers during large bank growth phase

– 1] Comprehensive

product suite 2] Solution driven knowledge banking approach 3) Leadership in

technology 4) Prudent risk management 5] Expansive reach 6] Experienced

leadership 7] Vibrant Yes Bank brand

CASA market share has more than doubled to 1.5% over FY16-18 while

incremental loan market share during FY18 stood at 9.2%

60% of the book is linked to MCLR of which 2/3rd of the book is linked to 1yr

MCLR. Margins are thus expected to recover from 3QFY19

Credit cost has been under control over past several years and banks expects

RoE to remain in 20%-22% range after FY20

Research covered

Cos/Sector

AGIC: CEO Track

Takeaways

Key Highlights

Yes Bank | AU Small Finance Bank |Dabur India | Pidilite Industries |

TeamLease

Automobiles | Capital Goods and Electricals | Cement | Consumer |

AGIC:

Financials – Bank | Life Insurance | NBFC | Healthcare | Metals | Oil

Management Says

& Gas | Technology | Telecom | Midcaps/Others

Piping hot news

The rupee slipped to a record low of 70.64 against the dollar on Wednesday in intra-

currency trades and staged only a limited recovery to end the session at 70.59. The Indian

currency has now lost nearly 10% since January making it Asia’s worst performing currency.

It was possible, dealers said,…

Rupee slips to record closing low of 70.59

Note: YTD is calendar year, *Avg

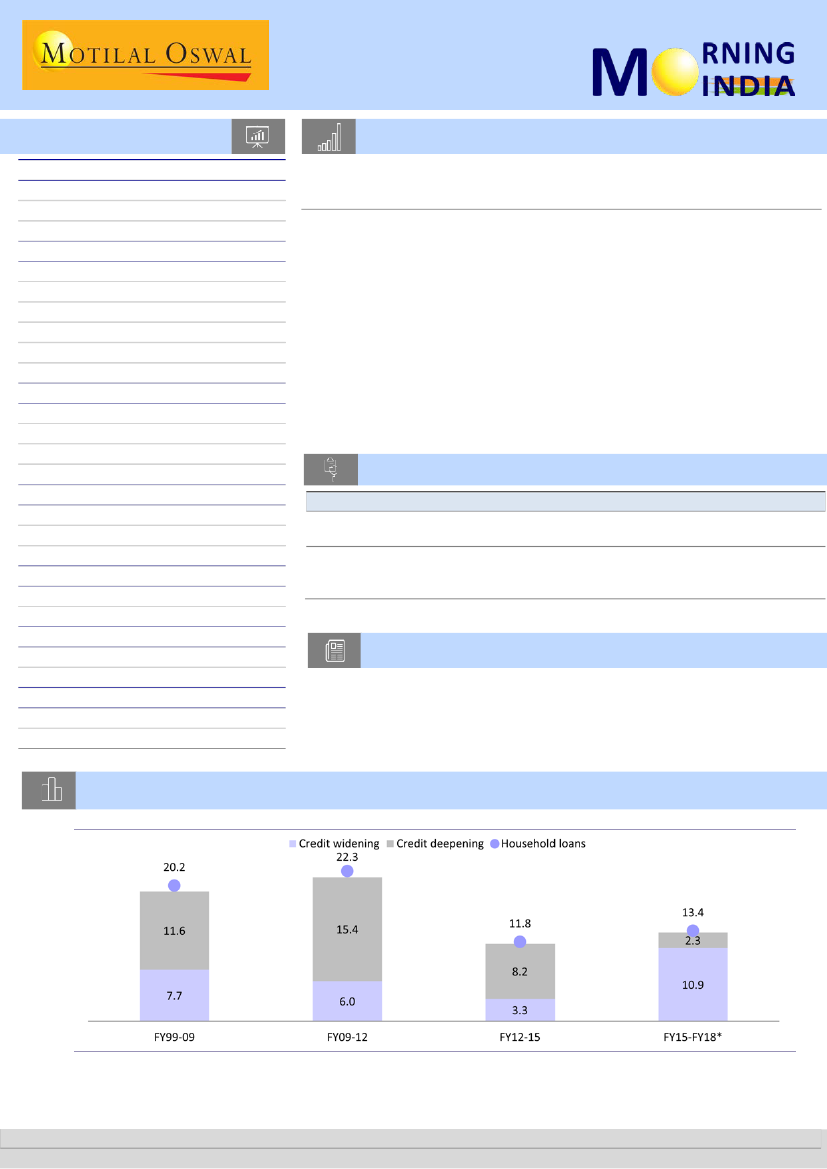

Chart of the Day: EcoKnowLedge – How sustainable is the leverage of Indian households?

Drivers of banks’ household loans during the past two decades

* Up to December 2017

Credit widening = No of accounts (volume); Credit deepening = Loan/account (Value)

Source: RBI, CSO, CEIC, MOSL

Research Team (Gautam.Duggad@MotilalOswal.com)

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.

Investors are advised to refer through important disclosures made at the last page of the Research Report.