10 September 2018

Market snapshot

Equities - India

Sensex

Nifty-50

Nifty-M 100

Equities-Global

S&P 500

Nasdaq

FTSE 100

DAX

Hang Seng

Nikkei 225

Commodities

Brent (US$/Bbl)

Gold ($/OZ)

Cu (US$/MT)

Almn (US$/MT)

Currency

USD/INR

USD/EUR

USD/JPY

YIELD (%)

10 Yrs G-Sec

10 Yrs AAA Corp

Flows (USD b)

FIIs

DIIs

Volumes (INRb)

Cash

F&O

Close

38,390

11,589

19,579

Close

2,872

7,903

7,278

11,960

10,560

22,307

Close

77

1,196

5,915

2,031

Close

71.7

1.2

111.0

Close

8.0

8.9

7-Sep

0.01

0.13

7-Sep

405

6,782

Chg .%

0.4

0.5

1.3

Chg .%

-0.2

-0.3

-0.6

0.0

-0.2

-0.8

Chg .%

0.5

-0.3

0.2

1.4

Chg .%

-0.3

-0.6

0.2

1MChg

-0.34

-0.02

MTD

0.3

0.3

MTD*

374

9,959

YTD.%

12.7

10.1

-7.4

YTD.%

7.4

14.5

-5.3

-7.4

-9.8

-2.0

YTD.%

14.8

-8.2

-17.9

-10.0

YTD.%

12.3

-3.8

-1.5

YTDchg

0.7

1.0

YTD

-0.4

10.6

YTD*

359

8,582

Today’s top research idea

Sun Pharma: Recent Halol 483 - Not a show stopper

US FDA recently conducted an inspection at SUNP's Halol plant from 27-31

August and issued Form-483 with six observations. We believe the observations

are resolvable and should not impact existing business and/or new approvals,

pertaining to SUNP.

We raise EPS estimate by 1%/3% for FY19/FY20 to factor in the favorable

currency movement. We expect a premium for SUNP to further expand from

25% to 35%, compared to an industry average of 20x 12M forward earnings on

the back of increasing share of specialty portfolio. SUNP is the only Indian-listed

entity, which is progressing well in the specialty portfolio.

We believe, the incremental generics business from new launches, which

should be higher than base business erosion, increased traction in specialty

products and sustained outperformance in the domestic formulation business

should drive growth. Accordingly, we revise our target price to INR790 (from

INR700 earlier).

Research covered

Cos/Sector

Axis Bank

Sun Pharma

NCLT & Insolvency

Day

Lupin – (ART)

EcoScope

Economy

Key Highlights

RBI approves appointment of new MD & CEO

Recent Halol 483 - Not a show stopper

Stressed assets outlook from India’s key ARCs and resolution experts

Besides competitive intensity, acquired businesses drag profitability

1QFY19 CAD below expectations

Monsoon deficit at 7%, kharif sowing 0.2% higher YoY

Piping hot news

A Securities and Exchange Board of India (Sebi)-appointed experts group on

Saturday made a slew of recommendations which are likely to soothe the nerve of

foreign portfolio investors (FPIs)…

Sebi panel eases deal for FPIs, allows NRIs to hold 25% in offshore funds

Note: YTD is calendar year, *Avg

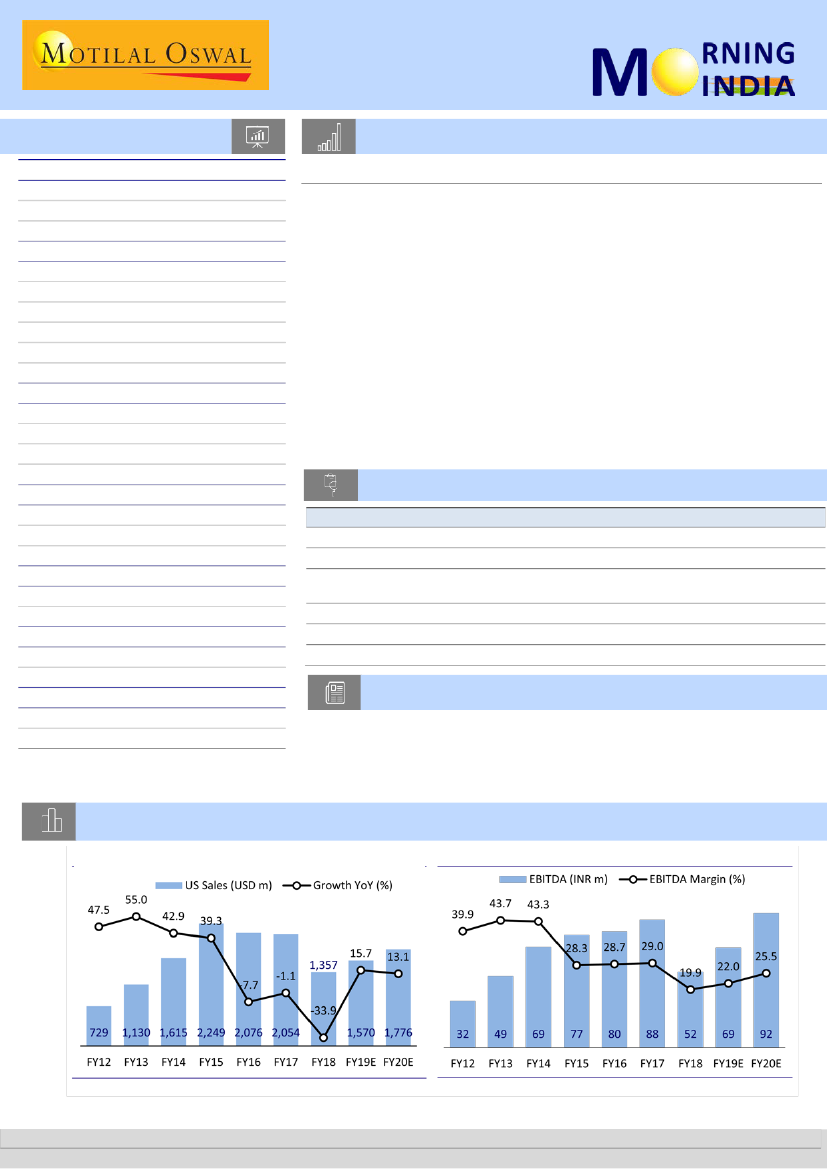

Chart of the Day: Sun Pharma— Recent Halol 483 - Not a show stopper

US sales to improve FY19 onwards

Margins to gradually improve

Source: Company, MOSL

Source: Company, MOSL

Research Team (Gautam.Duggad@MotilalOswal.com)

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.

Investors are advised to refer through important disclosures made at the last page of the Research Report.