*

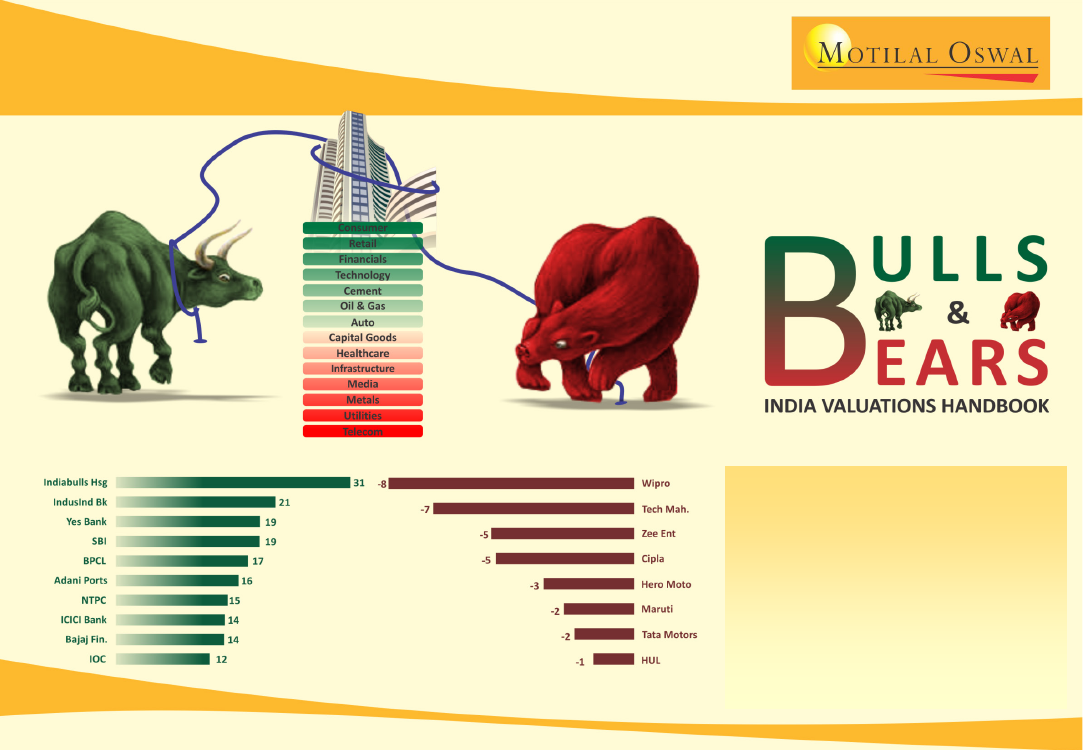

* Sectors in order of premium /

discount to historical averages

BEST PERFORMERS MoM (%)

WORST PERFORMERS MoM (%)

Highlights of Mar’19 edition

Nifty gains strength toward year-end —

up 15% in FY19

Banks and Technology top

outperformers of FY19

Mid-cap significantly underperform

large cap in FY19

FII flows weakest in 3 years

Research & Quant Team (Deven@MotilalOswal.com); +91 22 6129 1575

April 2019