8 April 2019

Market snapshot

Equities - India

Sensex

Nifty-50

Nifty-M 100

Equities-Global

S&P 500

Nasdaq

FTSE 100

DAX

Hang Seng

Nikkei 225

Commodities

Brent (US$/Bbl)

Gold ($/OZ)

Cu (US$/MT)

Almn (US$/MT)

Currency

USD/INR

USD/EUR

USD/JPY

YIELD (%)

10 Yrs G-Sec

10 Yrs AAA Corp

Flows (USD b)

FIIs

DIIs

Volumes (INRb)

Cash

F&O

Note: *Average

Close

38,862

11,666

18,246

Close

2,893

7,939

7,447

12,010

11,692

21,808

Close

70

1,292

6,385

1,864

Close

69.2

1.1

111.7

Close

7.4

8.4

5-Apr

0.12

-0.05

5-Apr

329

6,238

Chg .%

0.5

0.6

0.8

Chg .%

0.5

0.6

0.6

0.2

0.0

0.4

Chg .%

1.6

0.0

-0.8

-0.4

Chg .%

0.1

0.0

0.1

1MChg

0.01

0.01

MTD

1.41

-0.14

MTD*

387

10,487

CYTD.%

7.7

7.4

2.1

CYTD.%

15.4

19.6

10.7

13.7

15.5

9.0

CYTD.%

31.6

0.7

7.3

0.1

CYTD.%

-0.8

-2.2

1.9

CYTDchg

0.0

-0.1

CYTD

8.14

-1.89

CYTD*

357

10,074

Today’s top research theme

India Strategy | 4QFY19 Preview—India's PE movement: Politics to

Economy; Banks dominate the earnings revival

The 4QFY19 earnings-report season will be a repeat of 3QFY19, with Financials

driving the performance singlehandedly. Global Cyclicals - the driver of earnings

growth over the last few quarters - have decelerated sharply and are expected to

post decline of 14% in profit.

Corporate banks will account for entire growth in the Nifty and the broader

MOFSL Universe's earnings performance.

We expect MOFSL Universe PAT to grow 29% YoY. Defensives are expected to

post flat profits YoY, whereas Domestic Cyclicals will post 4x YoY jump in PAT.

We expect Nifty sales, EBITDA and PAT to increase by 11%, 2% and 15% on a base

of 16%, 22% and 8% growth, respectively. Ex-Corporate Banks, Nifty profits are

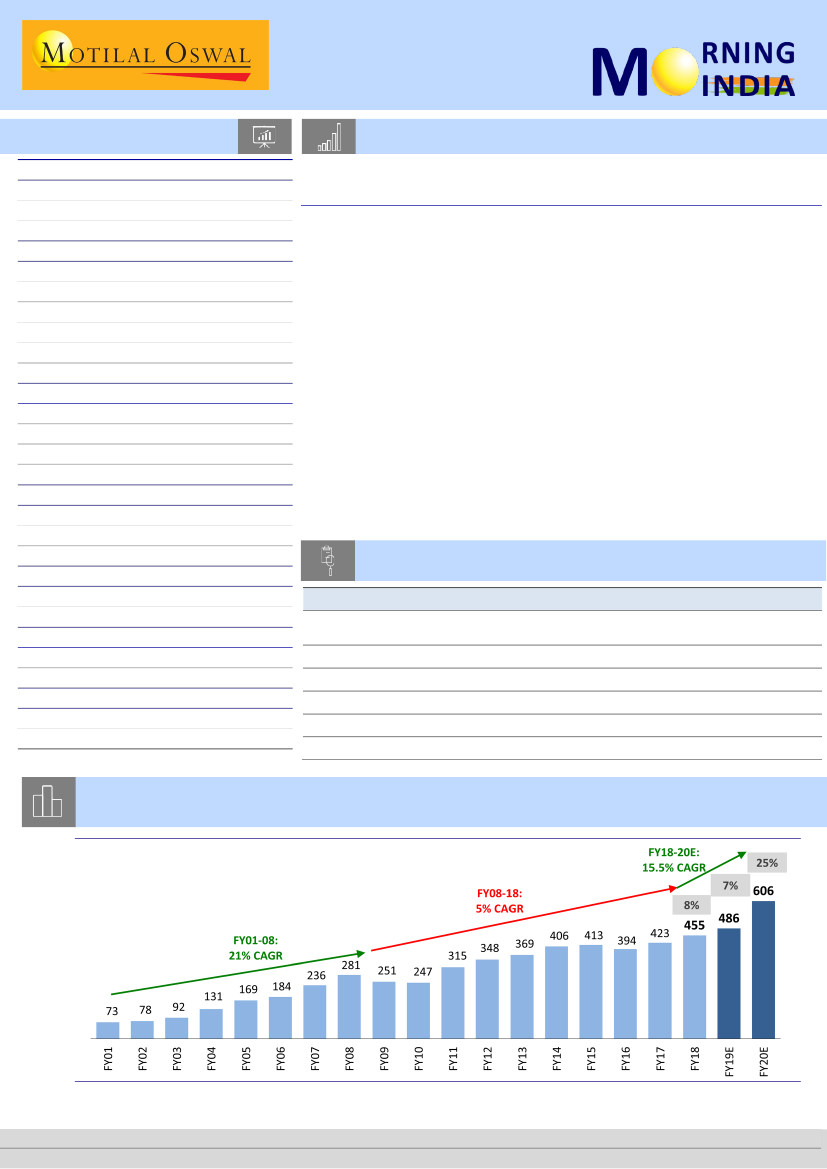

expected to decline 2.7% YoY. Our Nifty EPS estimates for FY19/20 have been cut

by 2.1%/3.6% to INR486/INR606 (prior: INR496/INR629), building in EPS growth

of 6.8%/24.8% for the Nifty for FY19/20.

Our top ideas: Large-Caps: ICICI Bank, SBI, Maruti, Titan, Coal India, Bharti Airtel,

L&T, Infosys,ACC. Mid-Caps: Federal Bank, Shriram Transport, Godrej Agrovet,

Indian Hotels, Marico, IGL, Exide, Jindal Steel, Alkem Labs.

Research covered

Cos/Sector

India Strategy -

4QFY19 Preview

Indiabulls Hsg. Fin

HDFC Bank

Financials

Gujarat Gas

NIIT Tech.

Key Highlights

India's PE movement: Politics to Economy; Banks dominate the

earnings revival

Announces amalgamation with LVB- a marriage of convenience

Advances in line; Deposit growth improves sequentially

Decoding FY19 – The turning point!

Strong volume growth outlook

Baring Private Equity Asia to acquire NIIT Ltd’s 30% stake

Chart of the Day: Nifty EPS – expect 16% CAGR over FY18-20, significantly higher than the

5% CAGR over FY08-18

Research Team (Gautam.Duggad@MotilalOswal.com)

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.

Investors are advised to refer through important disclosures made at the last page of the Research Report.