*

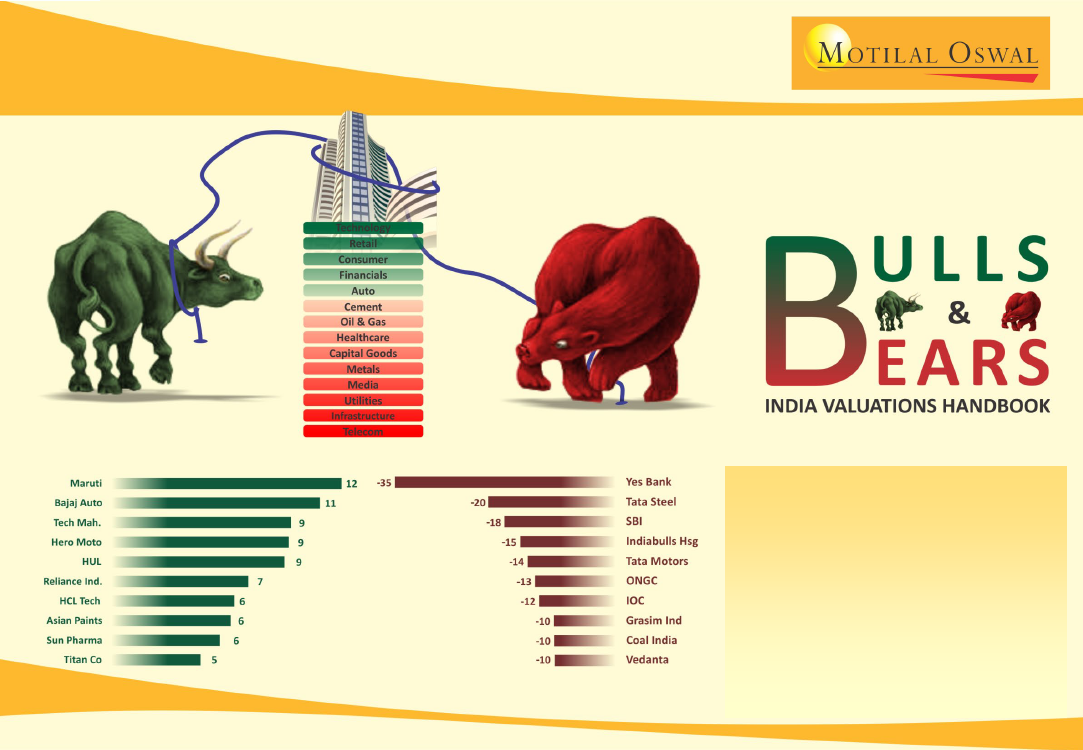

* Sectors in order of premium /

discount to historical averages

BEST PERFORMERS MoM (%)

WORST PERFORMERS MoM (%)

Highlights of Aug’19 edition

Market corrects for third straight

month – Nifty down 1% in August

Technology, Autos, NBFCs and

Healthcare outperforms

FIIs continue to be big seller for second

successive month

Research & Quant Team (Deven@MotilalOswal.com); +91 22 6129 1575

September 2019