Sector Update

Telecom | Update

| 16 April 2020

Media

Non-prime time clocks higher

consumption growth

All day

India

HSM

South

43%

49%

33%

Non-

Prime

Time

81%

97%

60%

Prime

Time

Lockdown a blessing in disguise?

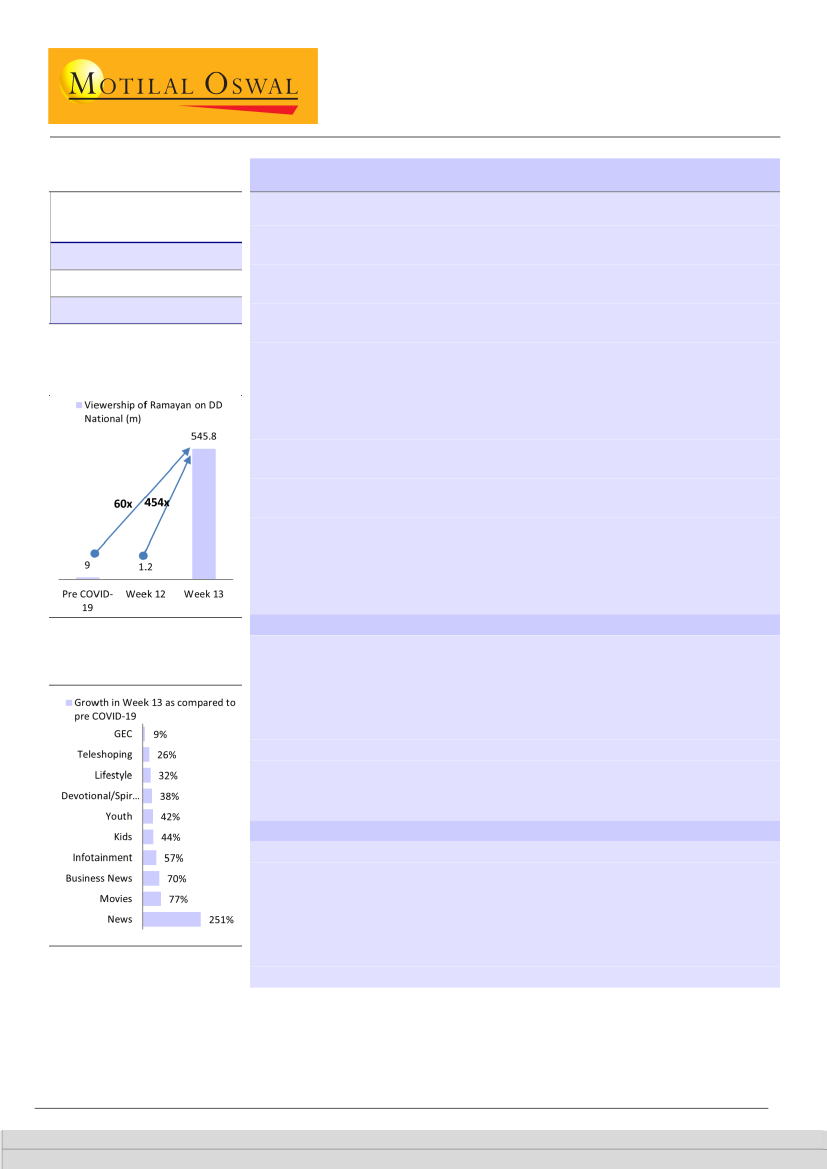

News/movies see disproportionate gains

The COVID-19 outbreak has led to a nation-wide lockdown and hampered economic

11%

growth; however, the broadcasting industry has been witnessing a huge uptick in TV

viewership. In this report, we discuss viewership growth of broadcasters and factors

13%

driving it, FCT trend, smartphone usage benefit to news channels and OTT, and impact on

6%

our coverage universe.

Ramayan’s viewership reached

546m in Week-13

The lockdown has positively impacted TV viewership in week-13 (starting 28

th

Mar’20).

According to a Broadcast Audience Research Council (BARC) report, viewership is up a

significant 43% since the pre COVID-19 period.

News, sports and movie genres have seen majority increase in viewership, while GEC,

given the lack of new content, have seen limited gains.

Amongst advertisers, spends are not broad-based. Only specific categories like the

government, FMCG companies and Ecommerce players are spending on

advertisements.

The time spent on smartphones has also increased with proportionate increase for

video streaming platform (VOD); original content and movies have seen

disproportionate gains.

Listed players like Zee TV, which are focused on GEC, have seen limited gains, while

Sun TV has seen improvement in market share.

Viewership grows across segments

Movies and news clocking growth in

Week-13 over pre COVID-19 period

Due to the nation-wide lockdown, TV viewership in India has increased by 43% (v/s

the pre COVID-19 period) owing to a higher number of channels and rise in average

daily time spent watching (up 27%). This is seen across regions (Hindi/South

markets) and across age groups (especially children and middle-aged consumers).

Viewership is no more restricted to prime time as non-prime time slots too have

clocked 81% growth. In week-13, across languages, viewership growth of

news/movies/sports channels have spurted 251%/77%/35% while for GEC, it was a

limited 9%.

FCT growth primarily in news and sports channels

During such economic uncertainty when nation-wide activities have halted, free

commercial time (FCT) has recorded overall growth of 9% in week-13, mainly led by

news/sports channel. GEC has seen limited growth of a mere 2%, which is in line

with viewership trends. This growth has been led by increase in social ads by the

government/NGOs to promote COVID-19 awareness and certain FMCG categories

that come under essentials (note that ads for toiletries have grown a massive 190x).

Research Analyst: Aliasgar Shakir(Aliasgar.Shakir@motilaloswal.com);

+91 22 6129 1565

Suhel Shaikh

(Suhel.Ahmad@MotilalOswal.com); +91 22 5036 2611;

Anshul Aggarwal

(Anshul.Aggarwal@motilaloswal.com); +91 22 5036 2511

Investors are advised to refer through important disclosures made at the last page of the Research Report.

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.