Sector Update | 22 November 2020

Sector Update | Financials

Financials

Technology

RBI releases the Report of the

Internal Working Group to Review

Extant Ownership Guidelines and

Corporate Structure for Indian

Private Sector Banks

RBI report on private sector banks’ ownership

Market share gains to accelerate for private sector banks

We view the RBI’s Internal Working Group (IWG) report related to the ownership of

private sector banks as progressive in nature. a) Suggestions for corporate/industrial

houses on how to get a banking license and b) allowing NBFCs (even belonging to industrial

houses) above asset sizes of INR500b to get banking licenses would increase healthy

competition, making the banking system more efficient, reducing intermediation cost, and

ultimately increasing credit penetration in the system. Over the last five years, private

sector banks have rapidly gained market share to ~30% (2020) from ~18% (2015), and we

see this trend accelerating at a faster pace now. M&A opportunities may also increase in

the system as corporates with deep pockets may adopt this route rather than building

from scratch. Fit and proper criteria, increased surveillance on group entities, the

maximum allowed promoter shareholding, and regulatory cost of CRR, SLR, etc. have been

the key considerations thus far for applying and granting banking licenses. It remains to be

seen how corporate India, NBFCs, and the RBI would approach the matter this time

around, once final guidelines are out. Prima facie, we see IDFC Ltd, Bajaj Finance, L&TFH,

Equitas, and Ujjivan to be key beneficiaries.

Long-awaited opportunity for corporate/industrial houses

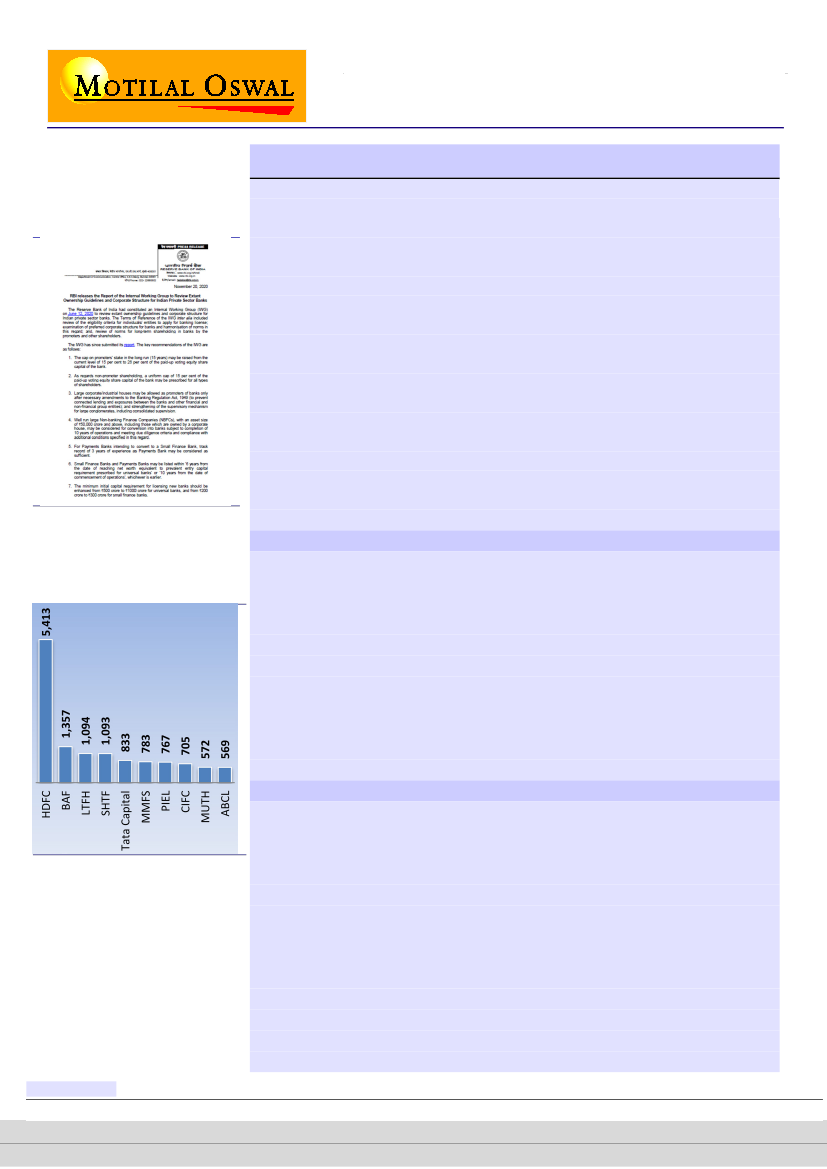

NBFCs with greater than INR500b

asset size (1HFY21, INR b)

One of the key suggestions in the report is to provide an opportunity for

corporate/industrial houses to get a share of the growing banking system pie. Apart

from 2013 guidelines, the RBI has thus far been averse to corporate/industrial

houses getting banking licenses. Even in the ‘on tap’ universal banking license

guidelines of 2016, corporate/industrial houses were not allowed to participate.

Some of them have a good understanding of the asset side via their NBFC arms. If

allowed, they would give strong competition to incumbents and may come up with

innovative solutions with no legacy baggage. We may see greater damage on the

CASA / retail liability front, especially at inefficient banks, as these entities have a

strong ecosystem and enjoy high levels of trust among people.

NBFCs’ proven business model on the asset side; fixing the liability side

NBFCs with assets sizes of INR500b+ and operating history should be given banking

licenses. Even entities promoted by corporate/industrial houses are eligible for the

same. In 2016, as per on tap licensing guidelines, NBFCs promoted by industrial

Source: MOFSL, Company; Note: Consol.

loans for ABCL, FY20 data for Tata Capital

houses were not eligible. The report is also silent on the requirement (part of 2013

guidelines) of a maximum of 40% of total assets/revenues of the group coming from

non-financial services. We believe certain NBFCs (including those promoted by

industrial houses) have created niche capabilities, increased credit penetration in

the system, and done a great job on the asset side. Even regulations for large-sized

NBFCs are coming on par with banks now. Banking licenses may resolve the issues

on the liability side – NBFCs had to suffer multiple shocks from events such as the

GFC, Taper Tantrum, the demonization, the IL&FS crisis, and the COVID-19

pandemic. Considering shallow bond markets, dependence on banks for such

entities is very high.

Research Analyst: Nitin Aggarwal

(Nitin.Aggarwal@MotilalOswal.com) |Himanshu

Taluja

(Himanshu.Taluja@motilaloswal.com)

Alpesh Mehta

(Alpesh.Mehta@MotilalOswal.com)

|

Yash Agarwal

(Yash.Agarwal@motilaloswal.com)

Investors are advised to refer through important disclosures made at the last page of the Research Report.

22 November 2020

1

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.