Sector Update | 8 January 2021

Sector Update| Healthcare

Healthcare

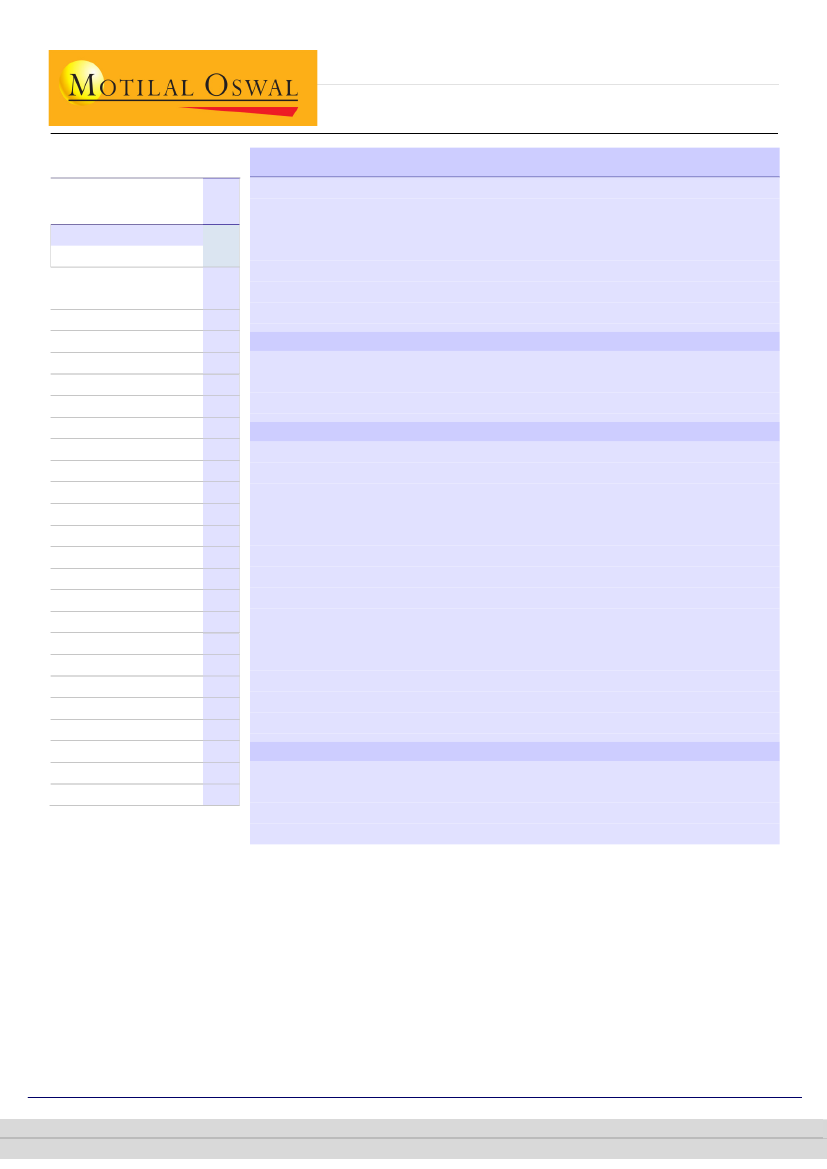

Performance of top companies:

Dec’20

MAT

Dec’2

Company

growth

0 (%)

(%)

IPM

Merck

JB Chemicals

Ajanta Pharma

Eris Lifesciences

Biocon

Ipca Laboratories

Cipla

Glenmark Pharma

Zydus Wellness

Lupin

Torrent Pharma

Wockhardt

Intas Pharma

Sanofi India

Abbott India

Mankind Pharma

Alkem Laboratories

Sun Pharma

Pfizer India

Dr. Reddy’s Labs

FDC

Indoco Remedies

GlaxoSmithKline Ph.

Alembic Pharma

Astrazeneca Pharma

Natco Pharma

3.1

19.0

14.3

10.0

9.2

-5.9

11.4

8.2

16.1

4.0

4.0

6.9

-21.4

4.4

4.0

4.1

6.0

1.0

4.4

7.4

2.1

0.6

-3.7

-5.4

0.8

3.2

-10.1

8.5

27.3

22.4

18.8

18.3

18.1

16.6

15.3

13.6

11.6

11.4

11.0

11.0

10.7

10.4

10.0

8.8

8.4

7.9

7.5

6.2

5.1

5.0

3.8

1.2

-2.5

-23.4

IPM growth accelerates in Dec’20 after a subdued Nov’20

IPM growth increased to 8.5% YoY in Dec’20 v/s. 1% YoY in Nov’20.

Gastro/Cardiac/VMN therapies exhibited a YoY growth of 16.2%/14.9%/14%.

Anti-Infectives therapy is back on the growth path, with 5.2% YoY growth in

Dec’20 v/s flat sales YoY in Nov’20.

Respiratory sales remained in a downtrend with 8.7% YoY decline in Dec’20.

NLEM (~17% of IPM) grew 6.3%% YoY. Non-NLEM (~83% of IPM) grew at 9%.

On a MAT basis, industry growth came in at 3.1% YoY.

For the quarter-ending Dec’20, YoY growth was 6.4%. Price/new product (NP)

growth of 4.9%/3.4% YoY was offset to some extent by a 1.9% dip in volumes.

NLEM (~17% of IPM) grew 3.6% YoY, while Non-NLEM (~83% of IPM) grew 7%.

In Dec’20, Merck India (+27.3% YoY), JB Chemicals (+22.4% YoY), Ajanta Pharma

(+18.8% YoY), Eris Lifesciences (+18.3% YoY), and Biocon (+18.1% YoY) delivered

robust performances.

Ajanta Pharma grew on strong offtake in Pain/Cardiac therapies (~50% of

therapy mix), which grew 33.3%/28.7% YoY.

Biocon witnessed strong growth in its Anti-Infective (+107% YoY) and Anti-

Neoplastic (+67.3%) segments.

Ipca Laboratories posted good traction in Pain/Analgesics (+32.7% YoY) and

Gastro (27.4%) segments.

Alembic Pharma and Dr. Reddy’s Laboratories posted lower-than-industry

growth in Dec’20 (1.2%/6.2% YoY) v/s -0.8%/0.3% in Nov’20.

On a MAT basis, JB Chemicals/Torrent Pharmaceuticals reported the highest

price growth (+10.1%/7.3% YoY). Glenmark Pharmaceuticals saw the highest

growth in new launches (+14.7% YoY).

Chronic therapies saw strong growth with Cardiac/Anti-diabetic/VMN growing

at 13.4%/7.8%/6.6% YoY for MAT ending Dec’20.

Gynecology/Pain/Anti-infective sales declined 3.5%/2.8%/2% YoY impacting

overall growth to some extent.

Prices aided overall growth for the quarter-ending Dec’20

Merck, JB Chemicals, Ajanta, Eris Lifesciences, and Biocon outperform

Cardiac, Anti-Diabetic and VMN drive overall sales growth on a MAT basis

Tushar Manudhane – Research analyst

(Tushar.Manudhane@MotilalOswal.com)

Bharat Hegde, CFA – Research analyst

(Bharat.Hegde@MotilalOswal.com);

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.

Investors are advised to refer through important disclosures made at the last page of the Research Report.