Sector Update |

Update | Financials

Sector

10 February 2024

Financials

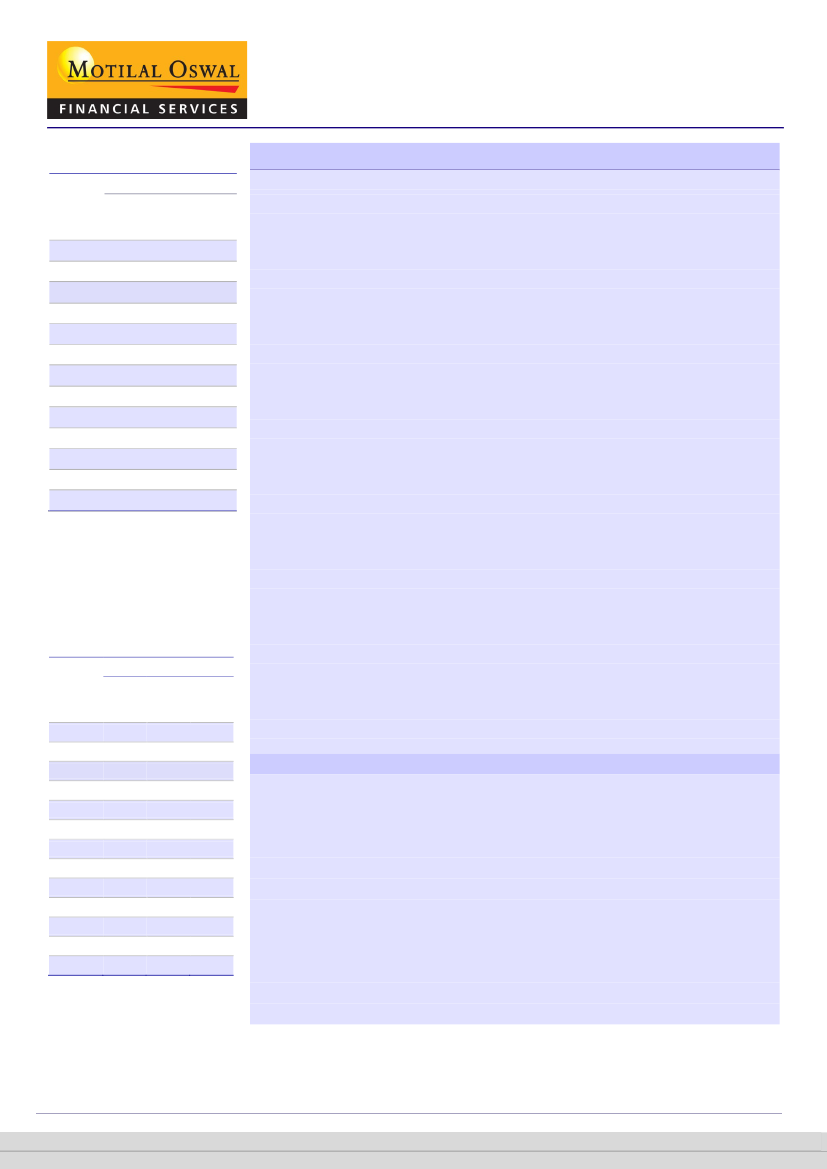

WALR on fresh loan declines; Pace of TD increase moderates

Month

Dec-22

Jan-23

Feb-23

Mar-23

Apr-23

May-23

Jun-23

Jul-23

Aug-23

Sep-23

Oct-23

Nov-23

Dec-23

PSU Banks

WALR – WALR - WATDR

O/s

Fresh

Loans Loans

8.92

8.22

5.76

8.97

9.07

9.14

9.16

9.18

9.19

9.22

9.24

9.23

9.25

9.25

9.28

8.36

8.56

8.67

8.49

8.57

8.50

8.72

8.80

8.63

8.67

8.60

8.51

5.89

6.02

6.15

6.27

6.37

6.46

6.54

6.62

6.75

6.80

6.85

6.88

NIM compression to continue

The weighted average lending rate (WALR) on fresh loans declined 9bp MoM in Dec’23,

Private Banks

WALR WALR - WATDR

- O/s Fresh

Loans Loans

10.48 9.67

5.89

10.54

10.61

10.65

10.72

10.74

10.81

10.65

10.64

10.62

10.59

10.59

10.62

9.72

9.87

10.08

9.68

9.87

9.99

10.01

10.16

10.18

10.20

10.23

10.20

6.02

6.10

6.24

6.36

6.44

6.53

6.62

6.67

6.69

6.75

6.76

6.83

Month

Dec-22

Jan-23

Feb-23

Mar-23

Apr-23

May-23

Jun-23

Jul-23

Aug-23

Sep-23

Oct-23

Nov-23

Dec-23

while it has increased 181bp since Apr’22. PSU banks (PSUs) reported a decline of 9bp

MoM, and private banks (PVBs) saw a decline of 3bp MoM. The decline in PSU banks’

WALR for fresh loans can be attributed to the uptick in the corporate segment, which

ideally should reflect lower yields.

Systemic WALR on outstanding loans, however, increased 5bp MoM (114bp increase

since Apr’22). This rise can primarily be attributed to the ongoing MCLR repricing,

especially at PSU banks with a significantly higher proportion of loans linked to MCLR.

The weighted average term deposit cost (WATDR) for the system has increased 4bp

MoM to 6.8% (3bp MoM increase for PSUs & 7bp MoM increase for PVBs). More

importantly, the increase in cost of WATDR has moderated significantly with the

December month witnessing the slowest MoM increase for both PSUs and PVBs over

the past one year.

With intense mobilization efforts and assertive increases in deposit rates, there has

been noticeable momentum in liability growth across banks (except for some select

large PVBs). Systemic deposit growth has thus improved to 12.4% YoY. The gap in

credit-deposit growth has also thus narrowed to ~3% vs. a peak of ~9% in Oct’22.

Credit growth for the system remains robust at 16% YoY and we estimate this to

sustain at a ~13.5% CAGR over FY25-26E. Importantly, the systemic LDR remains at

elevated levels of 79.9% (77.6% adjusted for HDFC merger). Most banks reported

incremental LDR of 80-140% over the past one year, with AU SFB at the lowest at 58.6%

and BOB at the highest with 139.3% in our coverage (HDFCB stands at 195.4% due to

the merger).

With repo rates remaining unchanged since Feb-23, lending rates have remained

broadly stable; however, funding cost has been gradually rising due to the ongoing

liability re-pricing. NIMs for the banking sector have thus been witnessing pressure

barring select banks. We expect NIM compression to continue at a more moderate

pace over the near term with PSUs continuing to show relative resilience. Top picks:

ICICI, IIB & SBI.

WALR on fresh loans decline 9bp MoM in Dec’23 (up 181bp since Apr’22)

WALR on fresh loans declined 9bp MoM in Dec’23, but has increased 181bp since

Apr’22, with PSUs seeing a decline of 9bp (up 174bp since Apr’22). PVBs too saw

a decline of 3bp (up 167bp since Apr’22). For the quarter, it declined 6bp, led by

a 12bp QoQ decline in PSU banks WALR. This indicates the rising competition

among banks to deliver healthy loan growth and a pick-up in corporate loan

growth. The increase over FY23 is a reflection of the rise in the repo rate, which

has cumulatively increased 250bp since Apr’22 to 6.5%.

WALR on outstanding loans nevertheless increased 5bp MoM (up 114bp since

Apr’22) to 9.86%, with PSUs experiencing a 5bp MoM increase and PVBs

remaining flat. This can be attributable to the MCLR repricing in the PSUs. The

one-year MCLR rate for PVBs increased 25-50bp YoY, with Federal seeing the

highest rise at 50bp, while PSU banks too seeing an MCLR expansion of 25-50bp.

Nitin Aggarwal - Research Analyst

(Nitin.Aggarwal@MotilalOswal.com)

Research Analyst: Dixit Sankharva

(Dixit.sankharva@motilaloswal.com) |

Disha Singhal

(Disha Singhal@MotilalOswal.com)

Investors are advised to refer through important disclosures made at the last page of the Research Report.

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.