Healthcare

Monthly

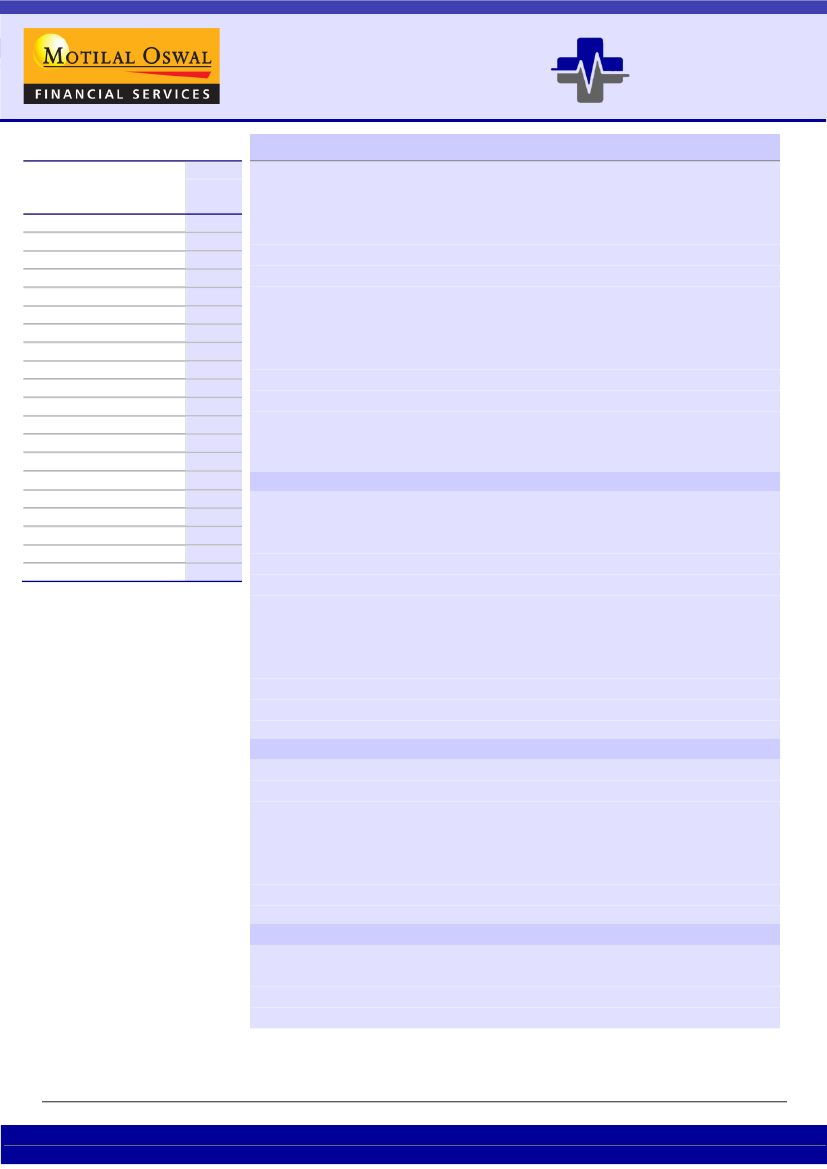

Performance of top companies in Feb’24

Company

MAT

growth

(%)

Feb’24

(%)

12 March 2024

Industry growth at high single digit for 2

nd

straight month

The India pharma market (IPM) grew 7.7% YoY in Feb’24 (vs. 8.0% in Jan’24 and

24.3% in Feb’23).

Major therapies driving growth were Cardiac/Derma/Neuro (up 13.1%/10.1%/

9.7% YoY) in Feb’24.

Respiratory/Anti-infective therapies declined 1.9%/1.0% YoY, dragging down the

overall performance of IPM.

For the 12 months ending in Feb’24, IPM grew 9.0% YoY. Prices/volume/new

launches witnessed 4.0%/2.0%/3.0% YoY growth.

Out of top 10 brands, Udiliv and Foracort (INR490m/INR790m) grew at 31%/20%

YoY in Feb’24. Rybelsus (INR300m) also registered the highest YoY growth of

88% in Feb’24 in top 40 brands.

Top anti-infective drugs such as DOLO/Calpol/Azithral/Clavam

(INR320m/INR360m/INR370m/INR520m) saw a decline of 20%/17%/17%/9%

YoY, resulting in an overall decline in anti-infective therapy.

IPM

Abbott*

Ajanta

Alembic

Alkem*

Cipla

Dr Reddys

Emcure*

Eris

Glaxo

Glenmark

Intas

Ipca

Jb Chemical*

Lupin

Macleods

Mankind

Sun*

Torrent

Zydus*

9.0

9.5

10.0

6.8

9.0

9.7

7.3

6.7

8.0

2.9

9.7

12.9

13.2

11.9

6.5

11.3

10.2

8.9

8.8

7.2

7.7

8.4

8.0

-0.5

4.0

8.8

9.5

5.8

11.7

3.5

10.7

13.0

15.6

10.8

7.1

8.0

9.7

8.2

8.6

4.8

IPCA/Intas/Eris outperform in Feb’24

In Feb’24, among the top-20 pharma companies, IPCA (up 15.6% YoY), Intas (up

13% YoY) and Eris (up 11.7% YoY) recorded notably higher growth than IPM.

IPCA outperformed IPM, led by strong performance of all the therapies and top

drugs.

Intas outperformed IPM, with Gynae/Anti-diabetic/Neuro posting growth of

20.3%/10.4%/12.3% YoY in Feb’24.

Alembic saw a decline of 0.5% YoY due to a double-digit decline in Anti-

infective/Respiratory and deterioration across all key brands.

JB Chemicals reported industry-leading volume growth of 7.1% YoY on the MAT

basis. Macleods Pharma registered the highest price hike of 7.3% YoY on the

MAT basis. Eris posted the highest growth in new launches (up 10.6% YoY).

Cardiac/Pain/Neuro lead YoY growth on MAT basis

On the MAT basis, the industry reported 9.0% growth YoY.

Urology/Cardiac/Pain grew 14.2%/10.3%/9.6% YoY.

Derma/Anti-Diabetic/Respiratory sales underperformed IPM by

370bp/360bp/230bp, hurting overall growth.

For the fourth consecutive month, Chronic therapy has outperformed acute

therapy. The Acute segment’s share in overall IPM was 62% for MAT Feb’24,

with YoY growth of 8.1%. The chronic segment (38% of IPM) grew 10.5% YoY.

MNCs outperform Indian firms after long time

As of Feb’24, Indian pharma companies hold a major share of 83% in IPM, while

the remaining is held by multinational pharma companies.

In Feb’24, multinational pharma companies have, for the first time in the last 12

months, posted better performance than Indian pharma companies.

Tushar Manudhane - Research Analyst

(Tushar.Manudhane@MotilalOswal.com)

Akash Manish Dobhada - Research Analyst

(Akash.Dobhada@motilaloswal.com)

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.

12 March 2024

Investors are

1

advised to refer through important disclosures made at the last page of the Research Report.