6 June 2024

E

CO

S

COPE

The Economy Observer

Capex Tracker: Corporate investments grow very slowly in FY24

Government and household capex healthy

For the sixth consecutive quarter in 4QFY24, real investments in India grew much faster than consumption. After a 6.9%

growth in FY23, real investments jumped 6.4%/8.9% YoY in 4Q/FY24, much higher than the growth of 3.4%/3.8% YoY in

real consumption (private + government). Further, nominal investments stood at a nine-year high of 33.3% of GDP in

FY24, compared to 33.0% of GDP in FY23. This regular

update

is intended to track India’s capex/investment trend and its

key drivers. Here are the key highlights:

Firstly,

the growth in government investments (Center + states) moderated to 12.0% YoY in 4QFY24, implying 26.7%

growth in FY24. The Center’s investments were largely flat in 4Q (vs. 15.6% YoY growth in 4QFY23), while states’ capex

rose 21.6% YoY in 4QFY24 (vs. +11.4% YoY in 4QFY23). Compared to an average of 3.6% of GDP in the 2010s decade, fiscal

investments were 5.2% of GDP in FY24, with a new peak for both the Center (at 2.7% of GDP) and states’ capex (at 2.6%

of GDP).

Accordingly, the government sector accounted for 16.5% of total investments in FY24, the highest since FY90 and up from

an average share of 11.6% in the 2010s decade. It also means that private investments (including public sector

enterprises, PSEs) grew only 6.1%/7.0% YoY in 4Q/FY24 vs. 10.2% in the 2010s decade.

Secondly,

using data on stamp duty and registration fees collected by states, our estimates suggest that household

investment (primarily residential real estate) contracted 1.2% YoY in 4QFY24, marking its first decline in 14 quarters. It,

however, grew 10.7% YoY in FY24, following an average growth of 29% during the past two years.

Lastly, as a residual, we find that corporate investment (including PSEs) picked up and reported 15.5% YoY growth in

4QFY24, the highest in five quarters. It, however, was much weaker at just 3.4% YoY in FY24 vs. ~21% growth in the last

two years. The share of the corporate sector, thus, likely contracted to a two-decade low of 42% of total investments in

FY24, compared to >50% in the pre-Covid years.

Overall, a strong residential property market holds the potential to boost economic activity, and the government’s focus

on infrastructure is commendable. However, weak personal income growth, high interest rates, fiscal consolidation, and

high economic uncertainties create vulnerabilities about the durability of the strong growth in investments.

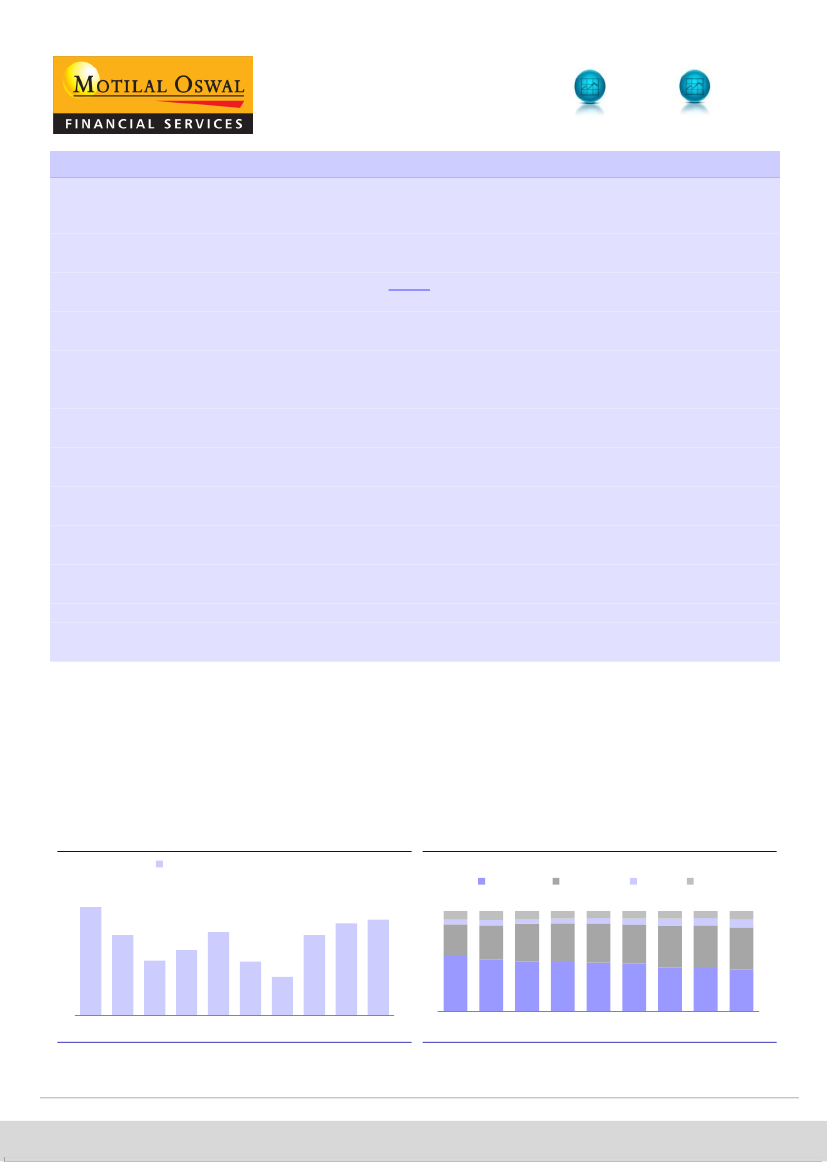

For the sixth consecutive quarter in 4QFY24, India’s real investments (the sum of

fixed investments, change in inventories, and valuables) grew much faster than

consumption (private + government). After a 6.9% growth in FY23, real investments

jumped 6.4%/8.9% YoY in 4Q/FY24, much higher than the growth of 3.4%/3.8% YoY

in real consumption. Further, nominal investments stood at a nine-year high of

33.3% of GDP in FY24, compared to 33.0% of GDP in FY23

(Exhibit 1).

Exhibit 1: India’s investment rate at a nine-year high of

33.3% of GDP in FY24

Total investments* (% of GDP)

34.3

32.1

30.2

31.0

32.3

30.1

28.9

56.3

51.8

49.7

49.0

48.5

47.3

43.4

32.1

33.0 33.3

7.9

5.4

30.5

8.8

5.6

33.9

Exhibit 2: Share of corporate sector slid in FY24; that of

government picked up

Sectoral investments# (% of total)

Corporate

7.8

4.8

37.7

Household

7.5

4.7

7.1

5.3

39.1

Center

7.6

5.8

39.3

7.4

7.4

41.7

States

7.0

7.3

8.1

8.4

41.8

41.7

38.7

41.5

44.3

FY15 FY16 FY17 FY18 FY19 FY20 FY21 FY22 FY23 FY24

* GFCF + Change in inventories + Valuables

FY16 FY17 FY18 FY19 FY20 FY21 FY22 FY23 FY24

# GFCF + Change in inventories

MOFSL estimates

Source: Various national sources, CEIC, MOFSL

Nikhil Gupta

– Research analyst

(Nikhil.Gupta@MotilalOswal.com)

Tanisha Ladha

– Research analyst

(Tanisha.Ladha@MotilalOswal.com)

Investors are advised to refer through important disclosures made at the last page of the Research Report.

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.