26 June 2024

Digital Payments Tracker

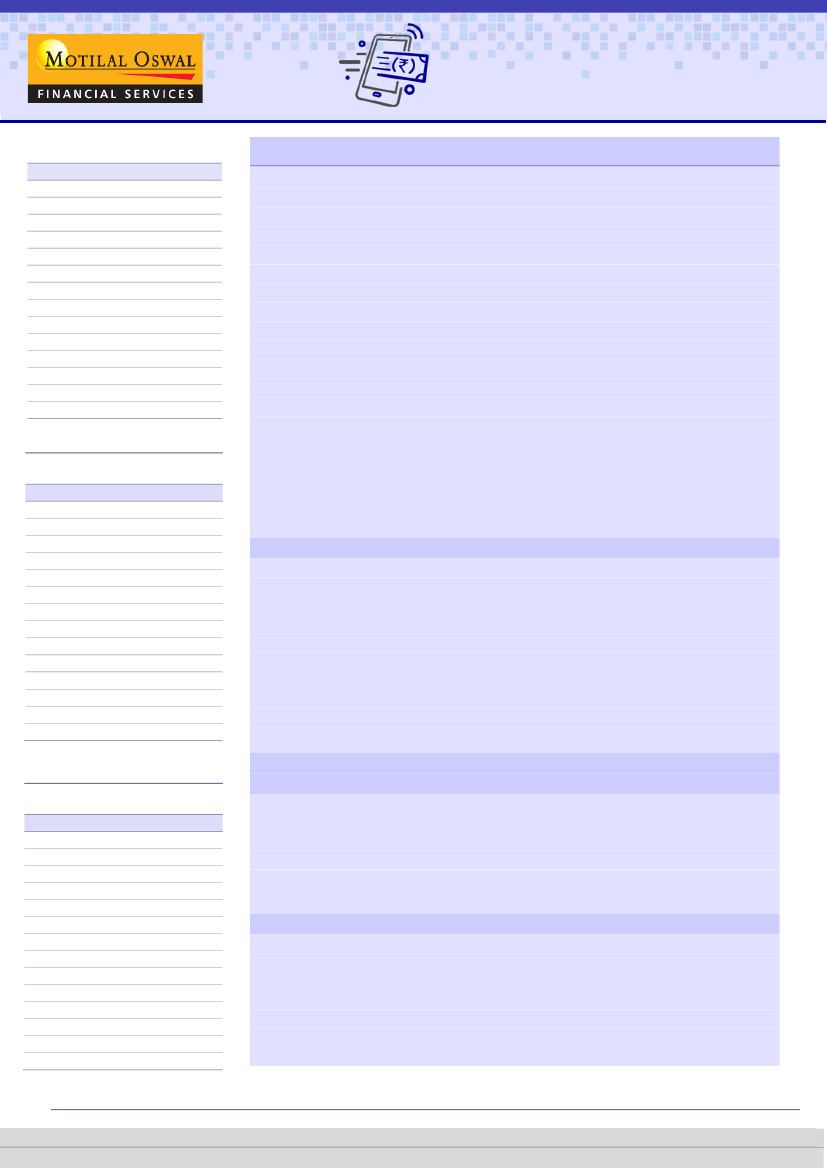

Card Addition

(Nos. in ’000)

Total Industry

HDFCB

AXSB

SBI Cards

IDFC First

ICICIBC

Yes

IIB

BOB

RBK

Federal

SBM

AMEX

SCB

KMB

May'24

760.6

289.1

117.1

113.8

88.9

76.7

40.9

30.1

21.8

17.8

15.6

6.7

6.5

2.9

-64.7

YoY growth

(%)

-38

19

-40

-60

62

-25

-707

-44

-37

-54

-62

-131

18

-155

NA

Credit card industry adds ~0.76m cards in May’24

Outstanding card base grew ~18% YoY; spending rose 17% YoY

Total spends and YoY growth (%)

YoY growth

(INR b)

May'24

(%)

Total

1,654.0

17.3

HDFCB

415.4

3.1

ICICIBC

320.2

30.6

SBI Cards

264.3

10.8

AXSB

192.7

11.1

IIB

82.5

15.2

RBK

75.2

24.2

KMB

73.6

42.7

AMEX

48.5

23.7

IDFC First

30.1

52.1

Yes

26.5

54.4

BOB

25.4

30.0

Federal

16.6

42.5

SCB

11.1

0.4

SBM

1.4

-6.4

Outstanding card base and YoY

growth (%)

YoY growth

(Nos. in m) May’24

(%)

Total

103.3

17.7

HDFCB

21.1

16.5

SBI Cards

19.1

11.5

ICICIBC

17.1

16.4

AXSB

14.3

15.0

KMB

5.9

16.0

RBK

5.2

14.7

IIB

3.0

27.5

IDFC First

2.7

68.8

BOB

2.6

30.1

Yes

2.2

48.4

AMEX

1.4

1.0

SCB

1.0

-2.5

Federal

1.0

55.4

SBM

0.9

-11.9

Source: MOFSL, RBI

The credit card industry added ~0.76m cards in May’24 (~0.74m in Apr’24 and ~1.2m in

Mar’24). Among large players, HDFCB witnessed highest growth, followed by AXSB,

SBICARD, IDFCB and ICICBC. The outstanding credit card base has thus increased to

103m, up 18% YoY.

During May’24, HDFCB added the highest number of new cards at ~289k, followed by

AXSB at ~117k, SBICARD at ~114k and ICICIBC at ~77k. KMB saw a sharp decline amid

RBI restrictions. Among emerging players, IDFCB reported strong growth at ~89k cards

during the month, taking its total card base to 2.7m.

Card spending grew 17% YoY to INR1.65t. Among key players, KMB, ICICIBC, SBICARD

and HDFCB witnessed 43%, 31%, 11%, and 3% YoY growth, respectively. IDFCF and FB

reported faster growth of 52% and 43% YoY, respectively.

Among key players, the share in card spending stood at 25.1% for HDFCB (-103bp

MoM), 19.4% for ICICIBC (+60bp MoM), and 16% for SBICARD (+27bp MoM). AXSB’s

share in card spending stood at 11.6% (-16bp MoM).

In terms of CIF market share, small and emerging players (IDFCB, BOB, IIB, FB) have

gained market share, while large players have been cautious with unsecured loans,

resulting in a slight decline in market share. HDFCB remains the largest player with an

outstanding card market share of 20.4%.

Outstanding credit card base grew ~18% YoY to 103m

The total number of outstanding credit cards in the system grew 17.7% YoY to

103.3m in May’24. Among key players, IIB and BOB reported strong YoY growth (up

27.5%/30.1%, albeit on a low base), followed by HDFCB (up 16.5%), ICICIBC (up

16.4%), KMB (up 16%), AXSB (up 15%), RBK (up 14.7%) and SBICARD (up 11.5%).

Among foreign players, Standard Chartered (SCB) witnessed a 2.5% YoY decline,

while AMEX grew 1.0% YoY. In terms of CIF market share, small and emerging

players (IDFCB, BOB, IIB, FB) have gained market share, while large players have

been cautious with unsecured loans, resulting in a market share decline for

SBICARD, AXSB, HDFCB, and ICICI by 102bp, 33bp, 22bp, and 19bp YoY to 18.5%,

13.9%, 20.4%, and 16.5%, respectively.

System added 0.76m cards in May’24; HDFCB added the highest number of

cards

The industry saw a net addition of ~0.76m credit cards in May’24 (~0.74m in

Apr’24), led by healthy traction by HDFCB, ICICIBC, AXSB, and SBICARD. HDFCB

added the highest numbers of new cards (~289k), followed by AXSB (~117k),

SBICARD (~114k), ICICIBC (~77k), IIB (~30k) and RBK (18k). KMB witnessed a sharp

decline of ~65k amid RBI restrictions. Among emerging players, IDFCB reported

strong growth of ~89k during the month, thus taking its total card base to 2.7m.

Card spending grew 17% YoY to INR1.65t

Card spending grew 17% YoY (5% MoM growth) to INR1.65t in May’24 (47% growth

on a three-year CAGR basis). Among the top players, KMB, ICICIBC, SBICARD, and

HDFCB clocked YoY growth of 43%, 31%, 11%, and 3%, respectively. IDFCB and FB

reported faster growth of 52% and 43% YoY, respectively. On a three-year basis,

spending for the industry recorded a CAGR of 47%, led by healthy growth for all

large players (40%-65% range). Among foreign players, SCB declined 1.2% MoM,

while AMEX grew 8% MoM.

Nitin Aggarwal - Research Analyst

(Nitin.Aggarwal@MotilalOswal.com)

Research Analyst: Dixit Sankharva

(Dixit.sankharva@MotilalOswal.com)

|

Disha Singhal

(Disha Singhal@MotilalOswal.com)

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.

Investors are advised to refer through important disclosures made at the last page of the Research Report.

26 June 2024

1