Sector UpdateUpdate | Technology

Sector | 26 November 2024

Financials - NBFCs

Motilal Oswal values your support in the

EXTEL POLL 2024 for India Research, Sales,

Corporate Access and Trading team.

We

request your ballot.

Best Domestic

Brokerage

# Ranked Top 3

(CY21-CY23)

Turbulence in the near term but fundamentals still robust

Regulatory scrutiny more intense than before; froth in valuations comes off

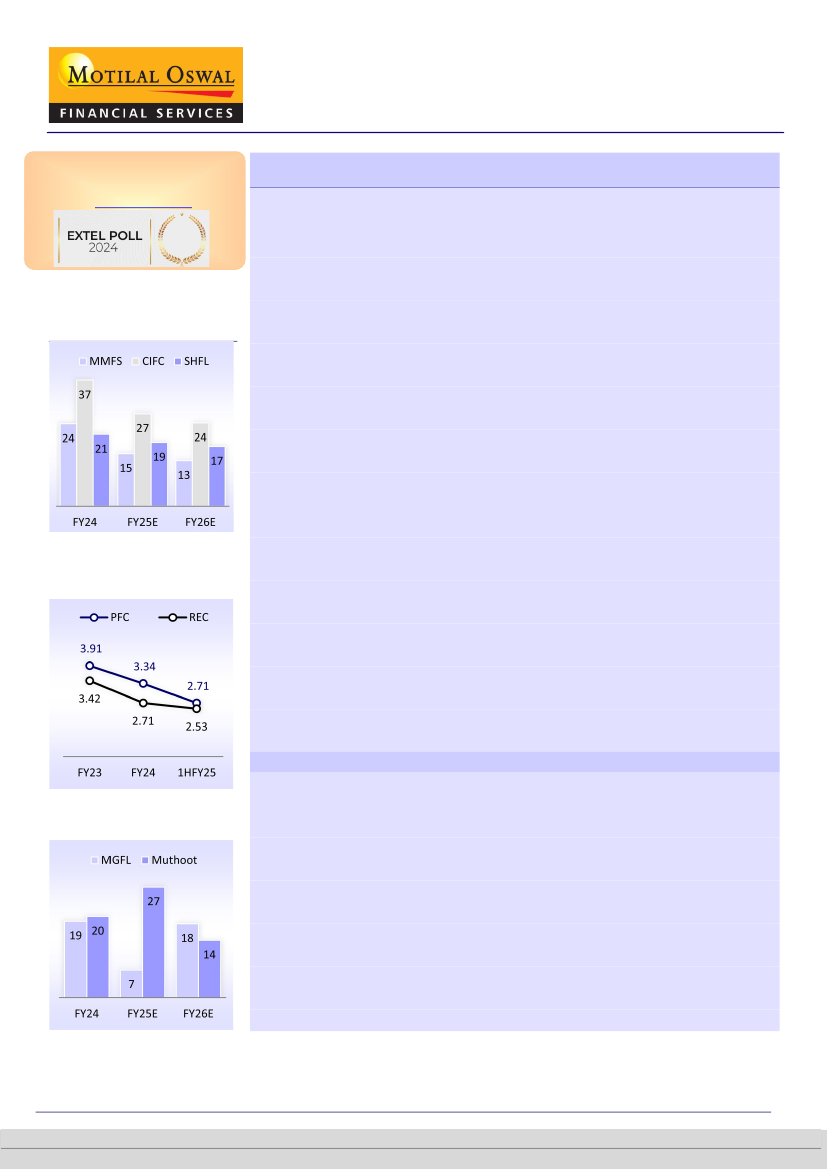

Vehicle Finance: AUM growth YoY

Power Finance: GNPA (%)

The past 12 months have been highly eventful for the NBFC sector. Over the

past year, we (in India as well as globally) have repeatedly moved our goalpost

for interest rate cuts, which are naturally expected to benefit the NBFC/HFC

sector. While repo rate cuts are yet to happen in India, what kept the NBFC

sector in the thick of the action (for better or worse) was the intense and

sustained regulatory scrutiny (occasionally even culminating in a ban on

business activity; Exhibit 2) and the weakness (over the last six months) in retail

asset quality, particularly unsecured. Add to this the narrative of a slowdown in

consumption, evident in the last quarter, which has prompted us to revisit our

outlook on loan growth for financial lenders.

This was followed by a correction in stock prices of NBFCs (alongside a decline in

the broader NIFTY and the Financial Services Index). The price corrections in

certain NBFCs were accentuated by the high ownership of FIIs (who have

recently been net sellers in Indian equities) despite strong earnings consistently

delivered by these companies over the past year (Exhibit 6).

NSEBank Index was up ~2% in the last three months and NSE Financial Services

Index was up 3% compared to NIFTY, which declined 3% over the last three

months. Within Financial Services, the brunt of the stock price performance was

higher for NBFCs due to the reasons we outlined earlier. Exhibit 5 shows the

price performance for the NBFC universe under our coverage. Among large caps,

we have seen a decline of 9% and 4% in CIFC and SHFL, respectively, over the

last three months. Exhibit 3, displays the earning cuts observed in our NBFC

coverage universe post 1HFY25 results.

Views on the NBFC sector and our recommendation at this juncture

Gold Finance: AUM growth YoY

We expect this turbulence in the NBFC sector to sustain in the near term given

the heightened anxiety that we sense among investors regarding the 1)

regulatory undertones and supervisory audits, 2) weakening of retail asset

quality, (particularly unsecured), and to a lesser extent, 3) moderation in the

outlook on loan growth in vehicle finance.

At this juncture and in the near term, it is important to identify hiding spaces

(safe zones) where one can park their investments rather than making

aggressive bets in the NBFC sector. One positive outcome from the recent

correction in the NBFC sector is that the froth that had built up in some NBFC

stocks has now come off and will soon start providing much more valuation

comfort instead of unsubstantiated expansion in P/BV multiples that we had

observed until recently.

Abhijit Tibrewal - Research Analyst

(Abhijit.Tibrewal@MotilalOswal.com)

Research Analyst: Nitin Aggarwal

(Nitin.Aggarwal@MotilalOswal.com) |

Raghav Khemani

(Raghav.Khemani@MotilalOswal.com)

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.

Investors are advised to refer through important disclosures made at the last page of the Research Report.