India Strategy

BSE Sensex: 77,984

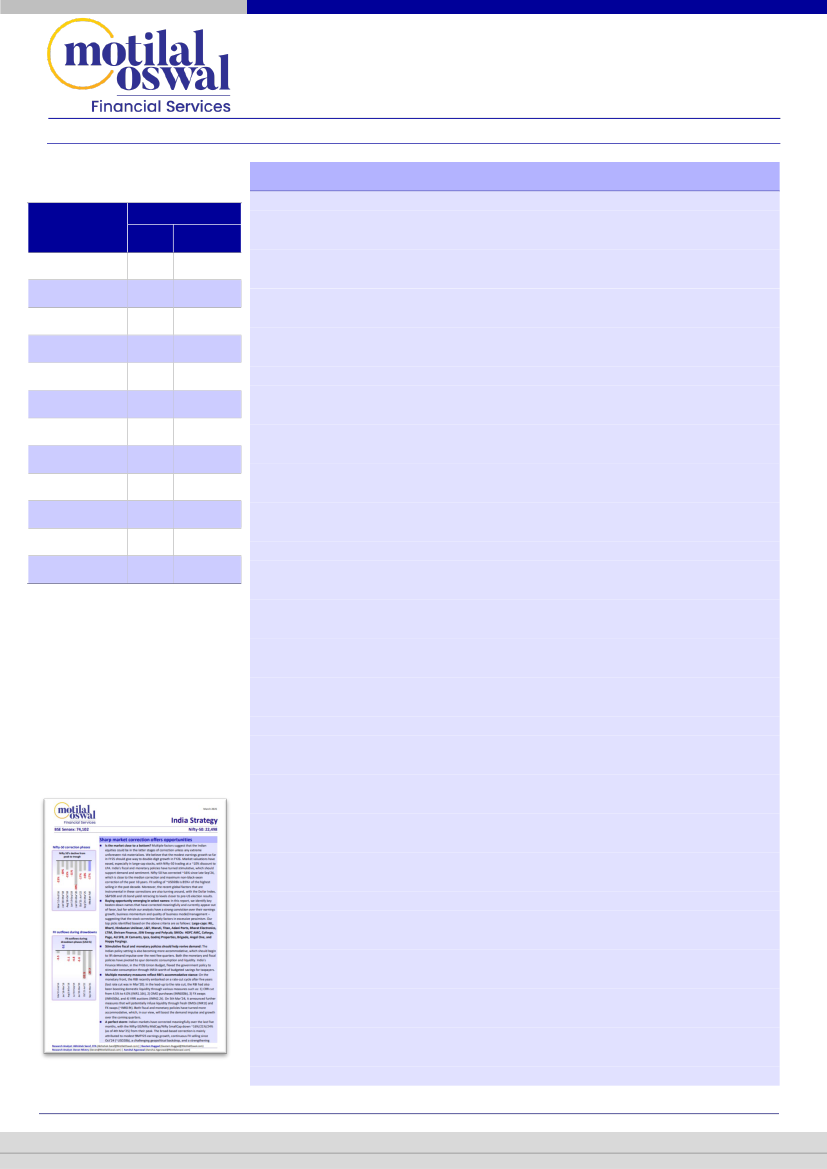

Performance during Nifty’s >10%

correction phases

Perf.*

Nifty-50

May'06 to

Jun'06

Feb'07 to

Mar'07

Jul'07 to

Aug'07

Jan'08 to

Oct'08

Nov'10 to

Dec'11

Mar'15 to

Feb'16

Jan'18 to

Mar'18

Aug'18 to

Oct'18

Jun'19 to

Sep'19

Jan'20 to

Mar'20

Oct'21 to

Jun'22

Sep'24 to

Mar'25

-30%

-15%

-12%

-60%

-28%

-23%

-10%

-15%

-11%

-38%

-17%

-16%

Relative Performance

Nifty

FMCG

-1%

4%

9%

25%

34%

10%

4%

1%

6%

13%

4%

-8%

Nifty

Consumption

0%

0%

1%

7%

14%

16%

3%

-3%

4%

11%

2%

-6%

March 2025

March 2025

Nifty-50: 23,658

Fishing for SMID Consumption picks

*Performance

Our recent Strategy report

“Sharp Market correction

offers opportunities”

Consumption likely to get better:

Demand and earnings for several listed

consumption stocks have been hit in 9MFY25, owing muted wage growth,

higher price levels, rising leverage, negative wealth effect etc. Importantly,

India’s policymakers have taken cognizance of weak consumption and are

adjusting both fiscal and monetary policies to boost aggregate demand,

liquidity, and sentiments. Selective stock picking opportunities have emerged, as

consumption indices have significantly underperformed over the past six

months. Valuations (MOFSL Consumer 12-month forward PE at 39x vs. Sep’24

peak of 54x) look less exacting now, while a beaten-down profit base and an

expected sequential demand lift should drive some earnings pickup in FY26

(Consumer: 13% YoY; Retail: 37% YoY). The sector can also benefit from light

positioning, as it is a common underweight across many top domestic funds.

A rare phase of underperformance for the consumption sector:

Nifty FMCG

and Consumption indices have fallen ~20%/17% from their peak in Sep’24,

underperforming Nifty100 by ~900-600bps. This is an aberration from historical

trends, as consumption indices typically outperform the benchmark during

phases of sharp market downturns. Nifty FMCG and Nifty Consumption indices

have delivered an average alpha of 10%/5%, respectively, during the past 11

phases of a 10%+ correction in the Nifty over last two decades. Current

underperformance can be explained by weak FY25 earnings (MOFSL-covered

consumption complex to post weak 2% YoY PAT growth). However, the factors

mentioned earlier can drive incremental positivity in select consumption names.

In this note our team suggests key SMID consumption plays across segments.

Sharp valuation correction offers entry points:

The MOFSL covered Consumer

& Retail stocks’ aggregate 12-month forward PE has corrected from the Sep’24

peak of 54x/109x to 39x/67x. The market cap of these segments has declined by

21% and 25% from their peaks to INR26.6t and INR9.9t. The divergence has

been significant in Retail names, with corrections between -9% and -61%, while

for Consumer, the range was between 0% to -36%.

Fiscal and monetary policies working in tandem; inflationary pressures easing:

The macro setting for consumption seems to be improving. In a not-so-common

coincidence, both fiscal and monetary policies in India are in a stimulative mode,

though at a measured pace. The INR1t of personal tax foregone in the FY26

Union Budget and multiple state-level income transfer schemes should drive

higher disposable incomes—a substantial portion of which is likely to be

channeled towards various consumption categories. To stimulate demand and

liquidity, the RBI, on its part, has utilized multiple monetary tools, such as 50bps

CRR cut, 25bps repo cut, liquidity injection through OMOs and FX swaps etc.

In addition, inflationary pressures appear to be easing, which should likely help

in reversing some of the price-induced demand contraction. With latest CPI

coming at 3.6% in Feb’25, our economist now expects a lower FY25 CPI print at

4.7% YoY (vs. 5.1% earlier) and further forecasts a benign 3.8% CPI for FY26.

Key picks:

In this note we highlight the following key SMID consumption picks

based on our analysts’ conviction on business and earnings growth:

Page

Industries, Devyani, Metro Brands, V-Mart, Lemontree Hotels, LT Foods, and

Cello World.

Research Analyst: Abhishek Saraf, CFA (Abhishek.Saraf@MotilalOswal.com | Gautam Duggad

(Gautam.Duggad@MotilalOswal.com)

Research Analyst: Deven Mistry

(Deven@MotilalOswal.com) |

Aanshul Agarawal

(Aanshul.Agarawal@Motilaloswal.com)

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.

Investors are advised to refer through important disclosures made at the last page of the Research Report.