Sector Update | 15 May 2025

Cement

South drives cement price gains, though demand remains tepid

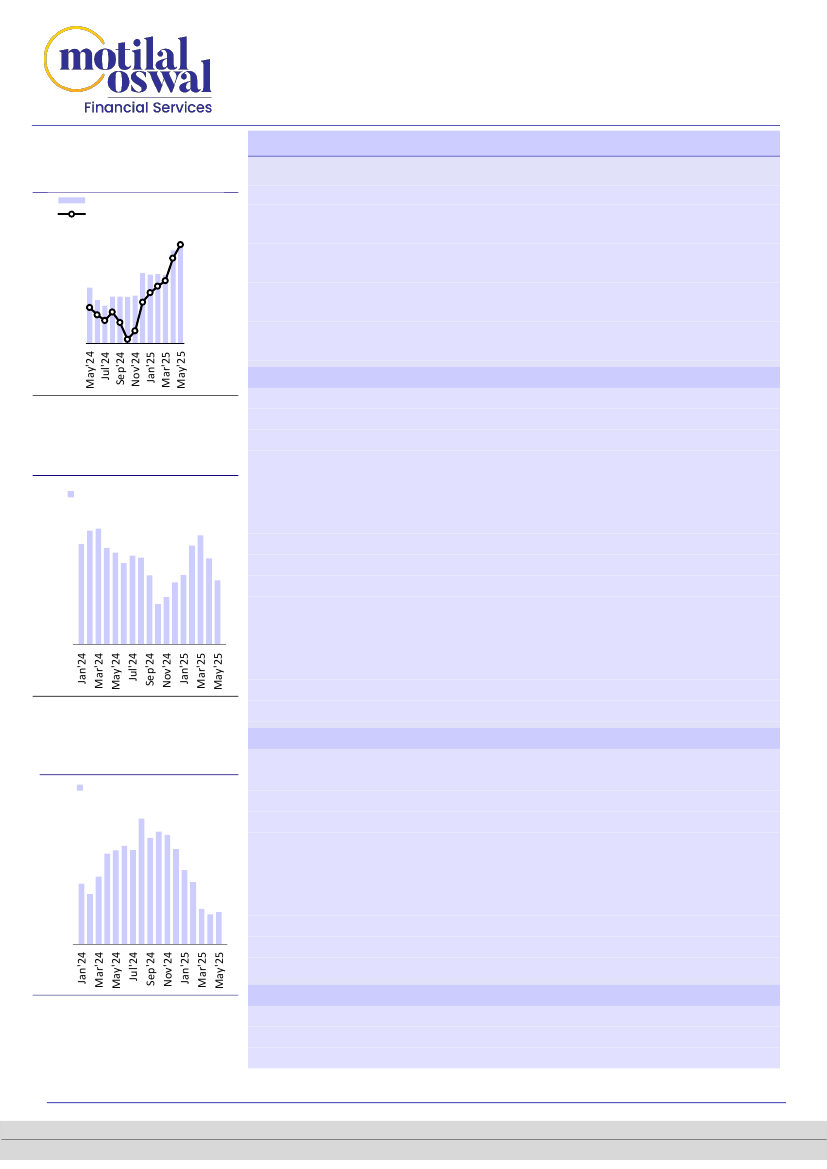

All-India average cement price up ~8%

YoY and 1% MoM in May’25

Average price INR/ 50 kg bag

Change YoY (%)

All-India average cement price up INR16/bag (~5%) QTD

Cement pricing has held up well, and the all-India average price has risen by INR5/bag (~1%)

MoM in May’25 and by INR16/bag (~5%) QTD in 1QFY26. This increase is primarily fueled by

sharp price hikes in the South, followed by the East region. Other regions have also seen firm

price gains on a QTD basis. Further, benign fuel prices continued to support cost efficiency

and margin improvement. Cement demand has been soft due to labor-related issues in a few

regions, unfavorable weather conditions, slower government spending, and a weak demand

from the individual housing (IHB) segment. We estimate industry demand growth in low

single digits (~3-4% YoY) in Apr’25. We believe sustaining the recent price hike is more

critical, with demand likely to recover over the medium term as macro conditions improve.

360

345

330

315

300

10.0

5.0

0.0

-5.0

-10.0

-15.0

South – focus on profitability drives sharp price hikes, up ~13% QTD in 1QFY26

Avg. imported petcoke price down 3%

YoY (-6% MoM) to USD108/t in Apr’25,

while spot price dipped ~8% sequentially

Imported petcoke price (USD/t)

120

110

100

90

80

Cement prices experienced a sharp increase of INR35-40/bag (average) in

Apr’25, rising ~12% MoM to an average trade price of INR358/bag. Prices rose

across key markets, up ~17%/16%/10%/5% MoM in Tamil Nadu/Kerala/Andhra

Pradesh/Karnataka in Apr’25.

Following a sharp price increase in Apr’25, industry players have announced

another hike of INR15-20/bag across markets from the second week of May’25,

though sustainability needs to be monitored.

After facing depressed margins through FY25, southern cement players are now

shifting focus toward improving profitability. They are strategically balancing

volume growth with margin improvement. Furthermore, following a wave of

M&A activity during FY25, acquirers are expected to prioritize the integration of

acquired assets, aligning them with the company’s standards, and operating

them profitably.

Earlier, the region witnessed a notable price increase of ~12%/13% YoY in FY15/

FY16, while demand growth moderated to ~5%/8% YoY. During this period, the

southern players reported notable improvement in profitability.

Average imported coal price down 16%

East – prices remain stable MoM in May’25, up ~7% QTD in 1QFY26

YoY (-2% MoM) to USD89/t in Apr’25,

In the East region, the average cement price has been flat MoM in May’25,

whereas, spot price flat sequentially

South African coal (USD/t)

120

110

100

90

80

whereas it has risen ~7% QTD in 1QFY26. After two consecutive months of price

hikes (Mar-Apr’25), the industry attempted another INR10/bag hike in May’25.

However, this hike was not sustained and was rolled back within a few days.

Demand in the East was healthy in Apr’25 but weakened in May’25 due to weak

demand from the IHB segment. Further, infrastructure demand has remained

subdued so far.

The East continues to witness capacity expansion from various players in the

next two years (estimated ~14mtpa grinding capacity addition in FY26/FY27

each). This could lead to higher competitive intensity and higher volatility in

cement prices over the near to medium term.

In the West region, cement prices largely remained flat MoM in Apr’25, followed

by a price hike of INR10/bag (~2%) announced in May’25. As a result, the

average cement price has been up ~1% QTD in 1QFY26.

West – price hikes announced in May’25, cement offtake strong in Apr’25

Sanjeev Kumar Singh - Research analyst

(Sanjeev.Singh@MotilalOswal.com)

Research analyst - Mudit Agarwal

(Mudit.Agarwal@MotilalOswal.com) |

Abhishek Sheth

(Abhishek.Sheth@MotilalOswal.com)

Investors are advised to refer through important disclosures made at the last page of the Research Report.

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.