Sector Update |

Sector Update

21 May 2025

Sector : Financials

Capital Market

Technology

x

Asia meeting highlights: Opportunities amid challenges

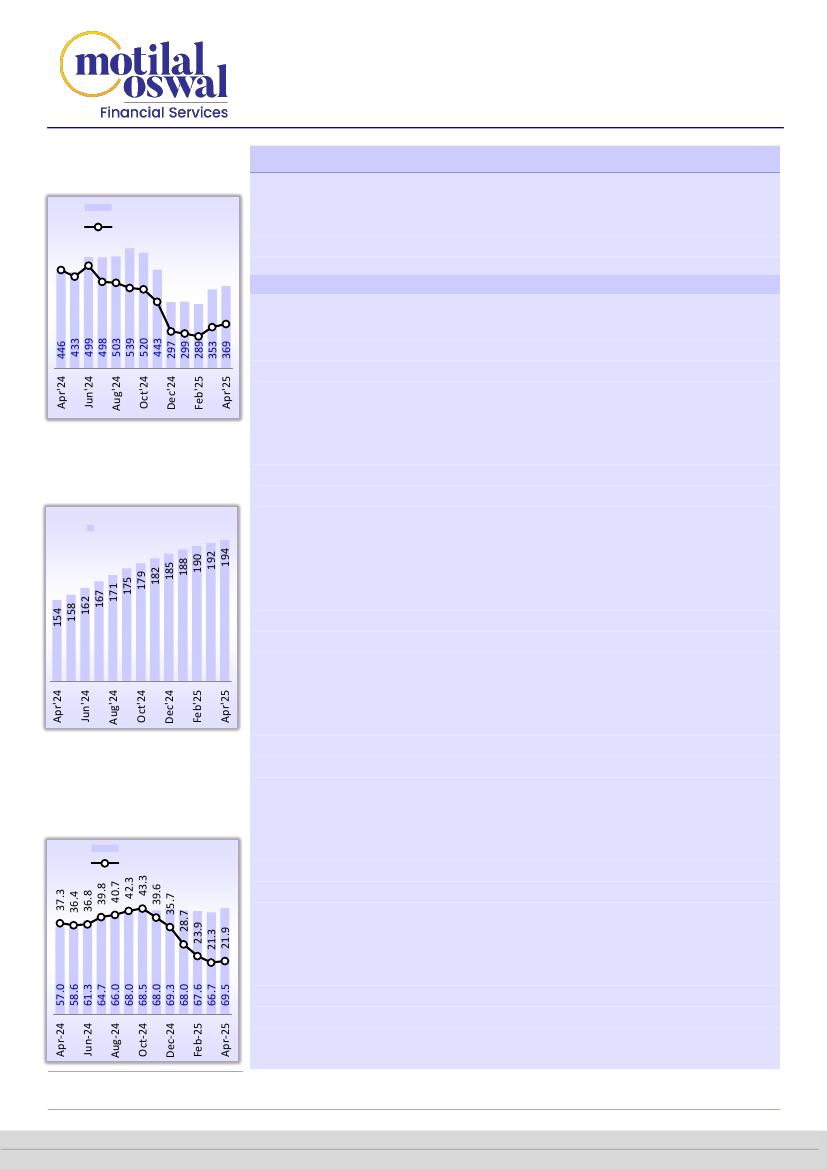

Total ADTO sees sequential growth

Total ADTO (INR t)

YoY Growth (%)

84

71

92

62 60 50

47

We met with 20 funds over the past week in Asia to discuss emerging themes in the

capital markets and the top ideas within this space. In this report, we highlight the

key points debated during these meetings regarding industry trends and specific

stocks such as BSE, Angel One, MCX, and Nuvama.

24

-17

-23

-31 -40

-35

Industry: Discussion on regulations and penetration

Are the F&O regulations now done and dusted?

Since Jun’24, the number of customers active in the F&O segment has declined

from 5.3m to 3.1m in Mar’25. A major part of the decline can be attributed to

the implementation of F&O regulations wherein 1) the number of weekly

expiries was reduced to one per exchange and 2) the lot sizes of Sensex and

Nifty were increased.

The pending outcomes of the consultation papers on 1) entity-level gross limits

on index options, 2) demerger of clearing corporations, 3) transfer of treasury

income of clearing corporations to customers, and 4) expiry days to be on

Tuesday/Thursday, which is an area of concern.

Whether the penetration in MFs and stocks reached optimum levels?

We have 200m demat accounts in India, of which ~110m are unique, ~50m are

active (defined by NSE as one trade in the past one year), ~10m traded in the

cash segment in Mar’25, and ~3.1m traded in the F&O segment.

The penetration remains starkly lower when compared with the economy’s

potential. Even in MF, with just ~54m unique investors, the penetration is

significantly lower.

Which segments have high sensitivity to equity market movements?

The most sensitive segments are where the business dynamics are linked to the

flow element of the business vs. the stock element. Resultantly, CDSL’s ~60%

revenue (transaction charges, IPO-related revenue, and KYC charges linked to

demat account openings) is the most sensitive to equity markets.

Further, for exchanges and brokers, a sustained market correction is envisaged to

be leading to a decline in volumes. Empirically, cash volumes have declined with

market corrections, but F&O volumes are the worst hit in a sideways market.

AMCs, wealth managers, and RTAs are the least sensitive to equity market

movements, as they earn on AUM, which has an element of regular inflows and

back book as well.

We anticipate a gradual recovery in volume growth, along with increased retail

participation, to support the ongoing growth trajectory of brokers and exchanges.

Additionally, improvements in equity mutual fund flows, driven by industry

initiatives to raise awareness and enhance financial literacy, will foster a long-term

investment perspective that is favorable for AMCs. Our top picks in the sector are:

ANGELONE, BSE, HDFCAMC, and Nuvama.

Demat accounts are inching up to

~200m

Demat Accounts (m)

MF AUM’s strong growth trajectory

MF AUM (INRt)

YoY growth (%)

Research Analyst: Prayesh Jain

(Prayesh.Jain@MotilalOswal.com) /

Nitin Aggarwal

(Nitin.Aggarwal@MotilalOswal.com)

Rs

Research Analyst: Kartikeya Mohata

(Kartikeya.Mohata@MotilalOswal.com) /

Muskan Chopra

(Muskan.Chopra@MotilalOswal.com)

Nitin)

Investors are advised to refer through important disclosures made at the last page of the Research Report.

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.