June 2025

India Strategy

BSE Sensex: 82,515

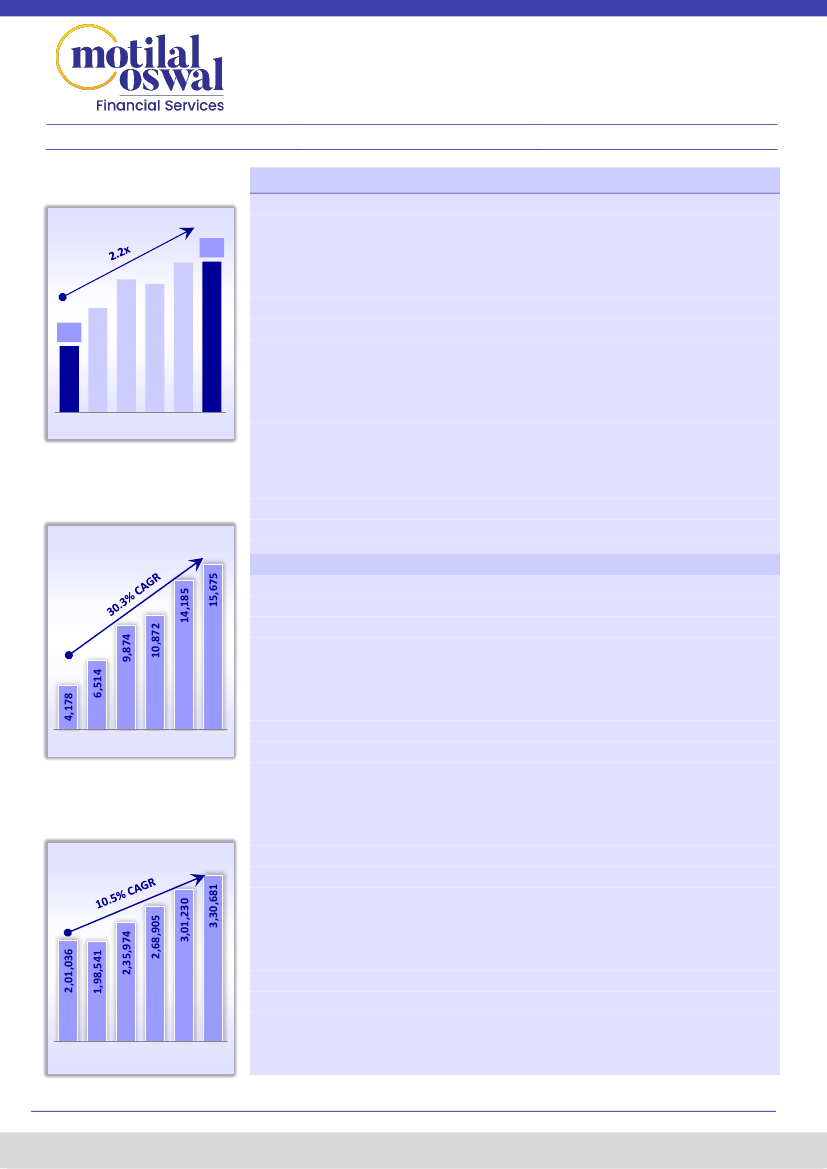

Corporate profit-to-GDP ratio

remains flat YoY, up 2.2x in five years

Nifty-50: 25,141

Corporate profit-to-GDP: Standing tall at a 17-year high!

Defying all odds:

As the world grapples with geopolitical challenges, sluggish growth,

high inflation, and elevated interest rates, India’s macroeconomic indicators present a

contrasting narrative. The country is experiencing strong GDP growth, a stable currency,

and moderating inflation and interest rates, alongside robust corporate earnings. For

the first time in many years, corporate earnings are tracking GDP growth, resulting in

the corporate profit-to-GDP ratio remaining flat YoY at a 17-year high of 4.7% in FY25.

This stable ratio was primarily driven by a healthy 10.5% YoY profit growth in FY25,

building on a strong earnings base of 30% YoY in FY24, which was broadly aligned with

the year’s revenue growth. This performance was bolstered by a robust GDP growth of

9.8% YoY in FY25, following a high base of 12% YoY growth in FY24.

Analyzing India's corporate profit-to-GDP ratio:

We take a closer look at the

corporate profit-to-GDP ratio achieved by India’s listed corporate sector. Our

analysis examines corporate earnings as a percentage of GDP in greater detail, using

the Nifty-500 as a proxy for corporate earnings, as this index represents ~90% of

India’s market capitalization.

4.7

4.2

4.0

4.7

3.3

2.1

2020 2021 2022 2023 2024 2025

Profits have grown at a faster pace

in the last five years

Nifty 500 PAT (INRb)

India’s corporate profit-to-GDP ratio in FY25: Under the lens

2020 2021 2022 2023 2024 2025

GDP has recorded a double-digit

growth in the past five years

GDP (INRb)

2020 2021 2022 2023 2024 2025

In 2025, the corporate profit-to-GDP ratio for the Nifty-500 Universe remained at

4.7%, marking a 17-year high. Notably, for listed India Inc., the ratio stood at

5.1%, at a 14-year high.

The sustained profit-to-GDP ratio for the Nifty-500 was

positively influenced by sectors such as Telecom (which shifted from being a

negative contributor for the past seven years to a positive contributor in FY25),

PSU Banks (with a 0.07% increase in the ratio), Healthcare (a 0.04% rise), Consumer

(a 0.04% increase), Metals (a 0.03% rise), and Infrastructure (a 0.2% increase). In

contrast, sectors that experienced a decline in the ratio included Oil & Gas (a 0.28%

decline), Automobiles (a dip of 0.03%), Cement (a decline of 0.02%), Utilities (a dip

of 0.02%), Private Banks (a decline of 0.01%), and Retail (a dip of 0.01%).

The top-5 sectors contributed 71% to the aforesaid ratio,

with BFSI (1.84% of

the GDP), Oil & Gas (0.51%), Technology (0.40%), Metals (0.34%), and

Automobiles (0.32%) being the key contributors. In contrast, e-commerce was

the only sector that contributed adversely to the corporate profit-to-GDP ratio.

The

corporate profits for the Nifty-500

universe experienced double-digit growth,

rising 10.5% YoY in FY25. This growth was notable given the high base of +30.5%

in FY24 and clocking a 30.3% CAGR over the past five years. This achievement

occurred in a challenging year characterized by weak consumption, a slowdown in

government spending during 1HFY25 amid elections, and volatile exports resulting

from heightened global uncertainties.

Meanwhile,

nominal GDP

growth remained strong in 2HFY25 and exceeded

market expectations. Nominal GDP expanded 9.8% YoY in FY25, although this

was slower than corporate profit growth during the year. It recorded a 10.5%

CAGR over the past five years.

Research Analyst: Gautam Duggad

(Gautam.Duggad@MotilalOswal.com)

| Deven Mistry

(Deven@MotilalOswal.com)

Research Analyst: Abhishek Saraf

(Abhishek.Saraf@motilaloswal.com) |

Aanshul Agarawal

(Aanshul.Agarawal@Motilaloswal.com)

(Aanshul.Agarawal@Motilaloswal.com)

Investors are advised to refer through important disclosures made at the last page of the Research Report.

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.