Rs

India Strategy

India Strategy | Earnings drought ending, finally!

July 2025

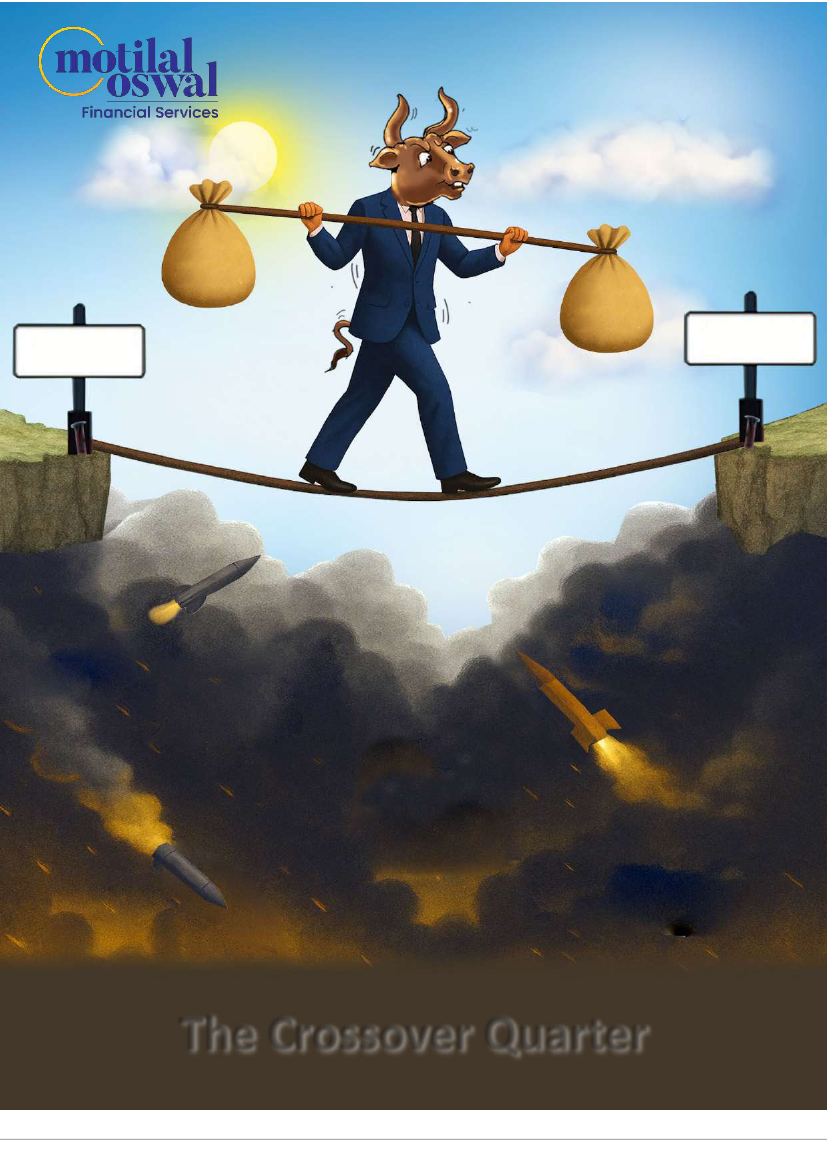

Strong

macros

Monetary

policy actions

Healthy

Earnings

Robust Domestic

Liquidity

Geopolitical

Tension

Trade Tariffs

Sluggish Global

Growth

Market

Volatility

The Crossover Quarter

Gautam Duggad

-

Research Analyst

(Gautam.Duggad@MotilalOswal.com)

Investors are advised to refer through important disclosures made at the last page of the Research Report.

1

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.

April 2021