With the new financial year comes appraisal and bonus, everyone must be planning of how to use it effectively. Many of you must have planned for holiday trip, or buying a car or jewelry etc. And, the followers of Warren Buffet must be planning for investing in Equity. You need to be very wise when it comes to invest your hard earned money. Motilal Oswal as a firm has seen many success due to its two very important strategies, one is value investing - check the worth or intrinsic value of the stock before investing and another one is Focused Investing.

In December 2016 our Chairman Mr. Raamdeo Agrawal published the 21st Wealth Creation Study titled Focused Investing.

The simplistic example of a hypothetical portfolio presented below shows how stock allocation can significantly influence investment performance. For the same set of stocks, 3 portfolios with different allocations turn in total return ranging from as low as -8.5 % to as high as +18.5 %.

Stock return

Allocation

Portfolio level Return

Portfolio 1

Portfolio 2

Portfolio 3

Portfolio 1

Portfolio 2

Portfolio 3

Stock 1

50 %

10 %

20 %

5 %

5 %

10 %

3 %

Stock 2

40 %

10 %

15 %

5 %

4 %

6 %

2 %

Stock 3

30 %

10 %

15 %

5 %

3 %

5 %

2 %

Stock 4

20 %

10 %

10 %

5 %

2 %

2 %

1 %

Stock 5

10 %

10 %

10 %

10 %

1 %

1 %

1 %

Stock 6

0 %

10 %

10 %

10 %

0 %

0 %

0 %

Stock 7

-10 %

10 %

5 %

10 %

-1 %

-1 %

-1 %

Stock 8

-20 %

10 %

5 %

15 %

-2 %

-1 %

-3 %

Stock 9

-30 %

10 %

5 %

15 %

-3 %

-2 %

-5 %

Stock 10

-40 %

10 %

5 %

20 %

-4 %

-2 %

-8 %

Portfolio

Total

100 %

100 %

100 %

5.00 %

18.50 %

-8.50 %

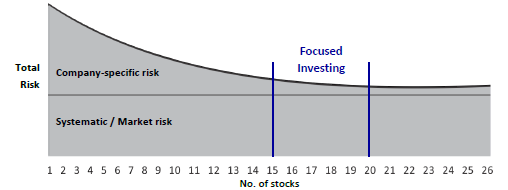

Focused investing as the golden mean of the two investment styles (Concentrated Investing& diversified Investing) compared to 50+ stocks under Diversified Investing and 10 or fewer stocks under Concentrated Investing, we recommend a focused portfolio. This offers the best of both world- adequate risk diversification & meaningful return magnification.

On the risk front, several studies have established that company-specific risks are sufficiently diversified by owning 15-20 stocks across sectors. Additional prudent allocation norms (e.g. not having more than 10 % under any single stock) can further reduce volatility of performance.

On the return front, having only 15-20 businesses allows meaningful allocations in high conviction stock ideas, magnifying overall portfolio return. An interesting 2012 study in the US showed that portfolios consisting of only the high-conviction bets of fund managers outperformed the very fund from which they were derived, and that too without significantly higher risk/volatility.

When you go for focused investing, value investing concept comes into picture… as to make a focused portfolio of 15-20 stocks you have to put all your knowledge and efforts to pick them up. Now, the question arise is how to pick those 15-20 stocks for your portfolio?

Here in Motilal Oswal we follow QGLP concept to pick up a stock:

Q – Quality of business and Quality of management,

G – Growth in earnings,

L – Longevity of Quality & Growth, and

P – Favorable Price of purchase.

The conclusion that can be drawn from this study is that one should consider focused portfolio with clear strategy, FIRST where risk analysis is to be delivered into your portfolios and the SECOND where the aspiration is for healthy alpha. A combination of both can deliver an exceptional returns rather than acceptable return.

Happy Investing!!

Best Regards

Harsh Joshi